The GBP/USD began this week on a bullish note, settling around the 1.3788 resistance level as of this writing, its highest since April 2018. The pound is supported by the weakness of the dollar and the global positive outlook towards Britain's vaccination progress, at a time when other global economies are struggling to obtain the same amount of vaccines Britain is getting. MUFG Bank expects a further increase in the price of the British pound. The bank is one of the leading global commercial and investment banks, who have told their clients that the UK's economic recovery from the COVID-19 crisis is likely to outpace other advanced economies.

In a regular Forex briefing note released on February 8, MUFG said that the UK vaccination program would cause a major recovery in consumer spending that is likely to surprise even the Bank of England's (BoE) optimistic growth forecast. “Given the progress in launching vaccines, the Bank of England now expects GDP growth from the second quarter of 2021 to the first quarter of 2022 of 14.2%, up from 10% in November,” says Derek Halpiny, head of research at MUFG. We believe that there may be upside risks to this prediction.”

The price of the pound sterling rose at the beginning of trading in 2021, on the back of the trade agreement agreement between the European Union and the United Kingdom that was agreed upon in late December 2020, the rise in stock markets and a view that the vaccination program in the country will achieve a strong economic recovery. These developments combine to reduce the chances of the Bank of England cutting interest rates again, which is what supports the pound.

In the same performance, the pound sterling rose to its highest level in 8 months against the euro and achieved significant gains against almost all major currencies in the world on February 4 after the Bank of England kept interest rates unchanged and indicated that a rate cut during the coming months is not likely now. Accordingly, the Forex market pricing showed expectations of a rate cut at least once in 2021 and the subsequent change of mind in the market was reflected in higher swap rates and a stronger sterling.

The bank's decision on interest rates supports the expectation of a strong economic recovery in the spring of 2021.

In an interview over the weekend with the Observer, Bank of England Governor Andrew Bailey said the UK is ready to spend after COVID, as money saved during the pandemic is triggered. Bailey also said there is a chance that after being locked up for so long, people will spend once vaccinations allow the economy to reopen. But the assumptions made by economists at the bank can be very cautious, according to MUFG.

Currently, the UK is close to vaccinating 20% of its adult population with the first dose of the COVID-19 vaccine, which is more than 3.70% of the population reached in the European Union. Most importantly, 75% of all COVID deaths in the UK are over the age of 75, and the government has now vaccinated more than 80% in this age group. In a matter of weeks, we will likely see a sharp drop in hospitalizations and deaths from the coronavirus. Meanwhile, the overall UK infection rate continues to decline sharply and is now 69% low at its peak with hospitalization rates dropping in response.

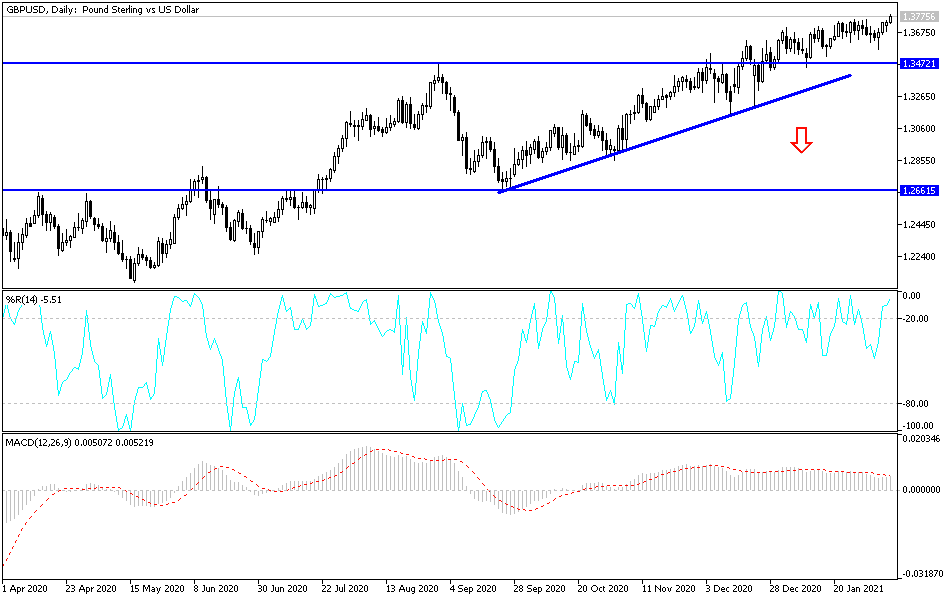

Technical analysis of the pair:

The general trend of the GBP/USD is still bullish, and according to the performance on the daily and weekly charts, a breakout of the resistance 1.3800 will push the technical indicators to strong buying saturation areas. Thus, profit-taking sales can occur at any time if the current upward momentum subsides. On the downside, the bears will first breach the downside of the current trend by moving below the support level of 1.3555. In general, I still prefer to buy the pair from every downside for the above reasons.