Although the US dollar recovered during last week’s trading, the GBP/USD pair made stronger bullish breakouts that resulted in a move towards the 1.4036 resistance, the highest for the pair in 3 years. The week closed stable around the 1.4000 psychological resistance level. The pound is poised to move towards stronger ascending levels. In particular, the move towards the psychological resistance of 1.40 increases the bulls' control over performance. We emphasized that the UK's vaccination progress will continue to support more gains. This progress will give the British economy strength even in the face of the effects of Brexit.

By the end of the week, it was announced that the preliminary Service PMI reading from Markit in the United Kingdom for February exceeded expectations of 41, with a reading of 49.7. The Manufacturing PMI also beat expectations by 53.2, with a reading of 54.9. UK retail sales excluding fuel posted a change of -8.8% (MoM), which was worse than the expected change of -2.6%. Sales (YoY) also missed the expected change of 2.2% with a change of -3.8%. General retail sales for the period were also below expectations. Prior to that, it was announced that the January CPI reading beat expectations (year-on-year) at 0.5% with a reading of 0.7%.

In the United States, Markit's Initial Service PMI for February beat expectations of 57.5, with a reading of 58.9. Initial jobless claims for the week ending February 12th missed expectations of 765K with 861K. The previous week's continuing claims were also lower than the expected number of claims at 4.413M, with a reading of 4.494M. February's Philadelphia Fed Manufacturing Survey beat expectations of 20 with a reading of 23.1.

The British pound made further gains against all of the major currencies except for the higher-yielding commodity currencies, but previous price action suggests that the pound and the euro may now be in a safe haven position. The British pound gave up some of its gains against the Australian, Canadian and New Zealand dollars on Friday as global stock and commodity markets rallied after what was otherwise a mixed week for the performance of risk assets, leaving many stock markets on their way to ending the loss-bearing period despite last-minute recovery rallies.

The S&P 500 and the NASDAQ indices were on their way to end last week lower, and so was the German DAX and the Swiss SMI, while the TSX in Canada and the ASX in Australia were still down strongly. Meanwhile, the US dollar and precious metals such as gold and silver were also mixed.

The pound's current strong bullish momentum points to further gains in the near term. A break above 1.4000 could open doors for a re-test of the April 2018 high of 1.4377. The government's plan to ease restrictions is creating a strong momentum.

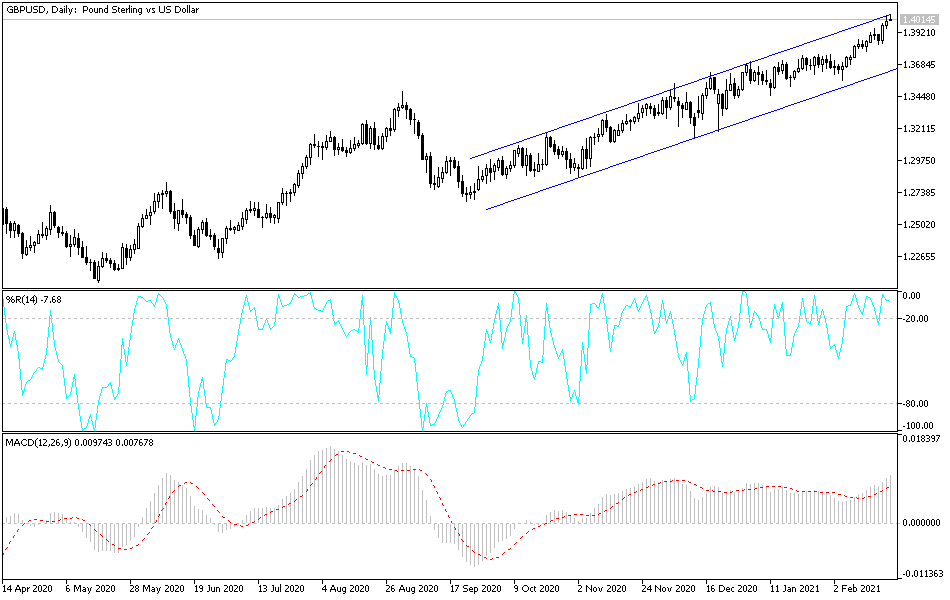

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the GBP/USD pair is trading within an upward channel formation, which indicates a short-term bullish momentum in market sentiment. The pair has risen near overbought levels in the 14-hour RSI. Accordingly, the bulls are looking to extend the current gains towards 1.4050 or higher to 1.4100. On the other hand, the bears will be looking to pounce on profits for a pullback around 1.4000 or below at 1.3950.

In the long term, and according to the performance on the daily chart, it appears that the GBP/USD has recently made a bullish breakout from the rising wedge formation, which indicates an increase in the long-term bullish bias in market sentiment. Accordingly, the bulls will look to maintain long-term control over the pair by targeting profits at the resistance level of 1.4216 or higher at 1.4385. On the other hand, the bears will target reversals to the support level of 1.3826 or lower at 1.3635.

Today's economic calendar is devoid of any important economic data, whether from Britain or the United States of America.