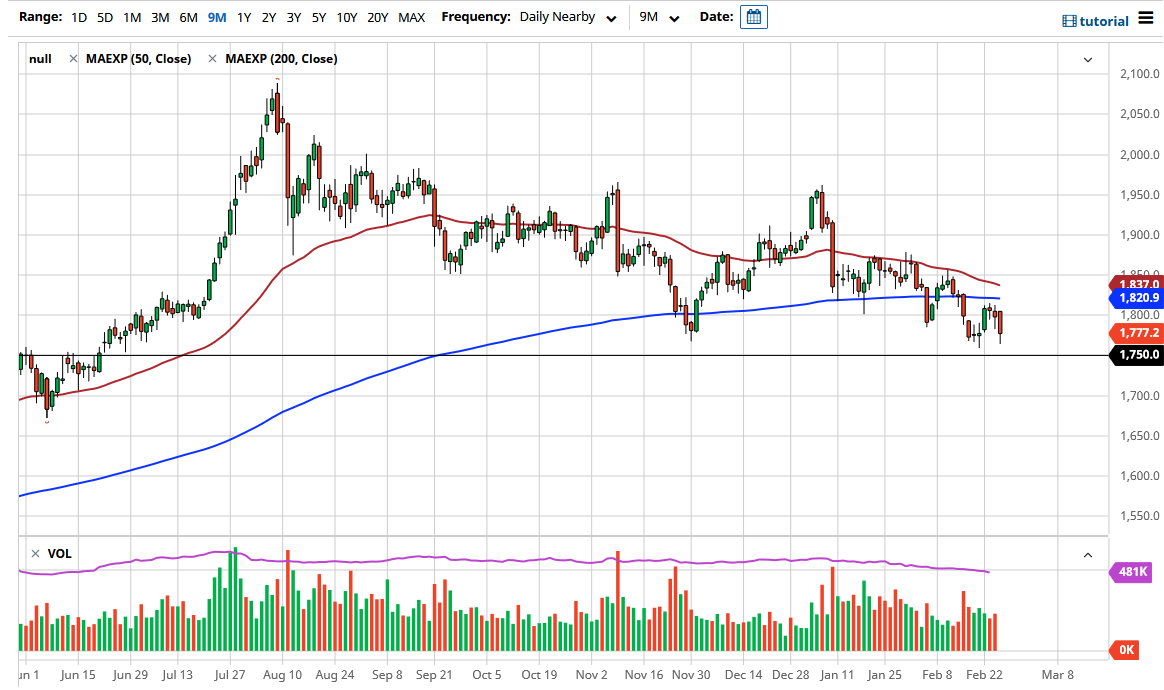

Gold markets got absently hammered during the trading session on Thursday, reaching down towards the $1765 level as the 10 year note fell with interest rates reaching the 1.50 level at one point during the day. That obviously works against gold as it is easier to simply clip coupons instead of paying for storage for gold. Higher interest rates are absolutely toxic for gold, and as a result it is looking more likely that we will eventually break down below the crucial $1750 level. If we do, then the market is likely to see a drop towards the $1500 level.

Ultimately, I think that once we get closer to that level, inflation will start to have people freak down, and we will see the US dollar get hammered. Once that happens, then gold will become much more bullish, and then kick off a much bigger move. However, as long as we have no real hint of inflation, gold is going to suffer as it basically serves as a hedge against inflation, or it should be stated that negative real interest rates is what drives gold higher. As interest rates rise in the 10 year yield, real interest rates become positive.

The size of the candlestick does suggest that there is a certain amount of bearish pressure in this market, and of course you should also keep in mind that the previous couple of candlesticks were hammers, so now that we have sliced through them that shows that the sellers have become even more aggressive and finally break the will of the short-term buyers. That is a very negative sign in and of itself, so I think you will continue to see sellers on short-term rallies as the 200 day EMA above continues to offer resistance. Furthermore, we have the 50 day EMA just above there, so I think there are plenty of reasons to look for trouble in this overall area.

In the short term, I think we are probably looking at a boundary between the $1750 level and the 200 day EMA that could keep this market somewhat sideways, so with that in mind I like the idea of playing short-term trade more than anything else, at least until we break out of this range. That being said, it is looking increasingly likely that the breakout will be to the downside once it finally does happen.