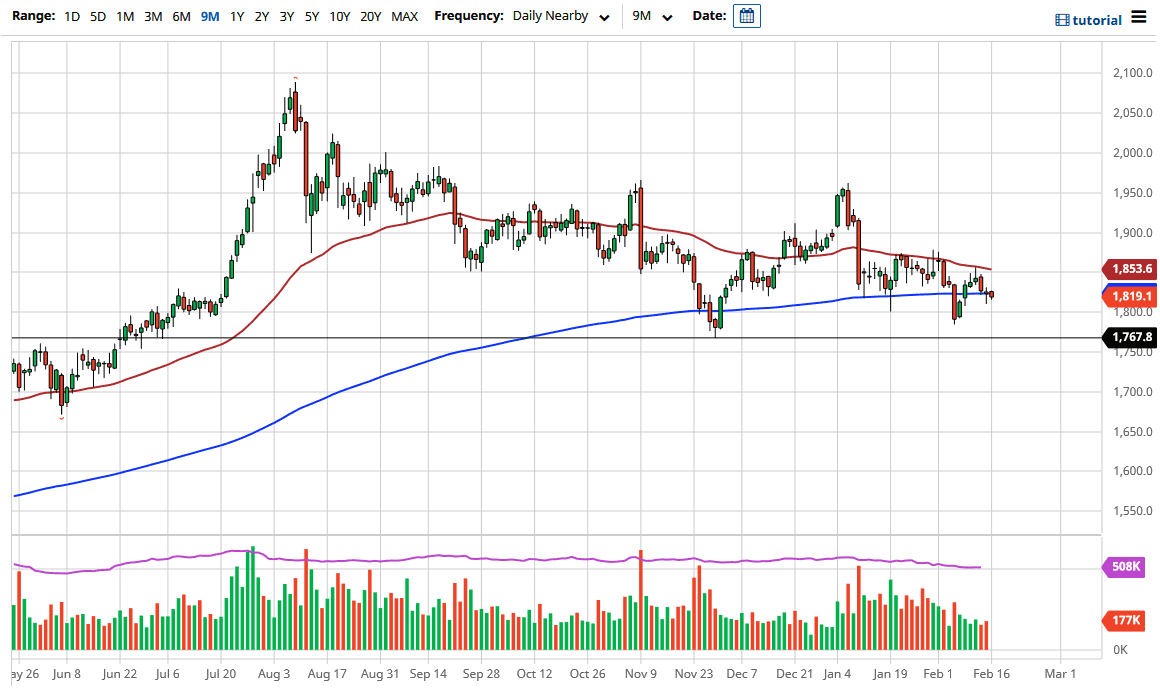

The gold markets continue to look very quiet, but that is not a huge surprise considering that the Americans were away for President's Day. The market is one that you can only read so much into during the Monday session, but I do believe that there is a lot of support underneath. The 200-day EMA is an area where a lot of people are willing to go back and forth, as the market is simply trying to figure out whether or not we are going to form some type of base for the move higher.

The area underneath should continue to offer support down to at least the $1750 level. If we were to break down below there, then it is likely that the market could go much lower, because I believe that would be the market breaking a serious amount of support in general. That could be driven by the interest rates in the 10-year note rising, which is like kryptonite for gold. After all, traders will be more likely to hang onto paper that offer some type of yield instead of gold, which does not. This is a market that I think will be very choppy in this area, so I am not necessarily interested in putting a ton of money to work here, but I am watching gold because I do believe that we could see some type of longer-term signal in this general vicinity.

For example, if we were to turn around and break above the 50-day EMA, then I think the market would probably continue higher, perhaps reaching towards the $1900 level, and then possibly even the $1960 level. That would also coincide with the US dollar falling, so that is something worth paying attention to. However, if we break down below that $1750 level, I am willing to put money to the short side, as that could open up a move down to the $1500 level. In general, I think the next couple of weeks are going to be very choppy as we try to figure out what is going on in the treasury market and the gold market, as the two are so tightly correlated to each other in these types of environments.