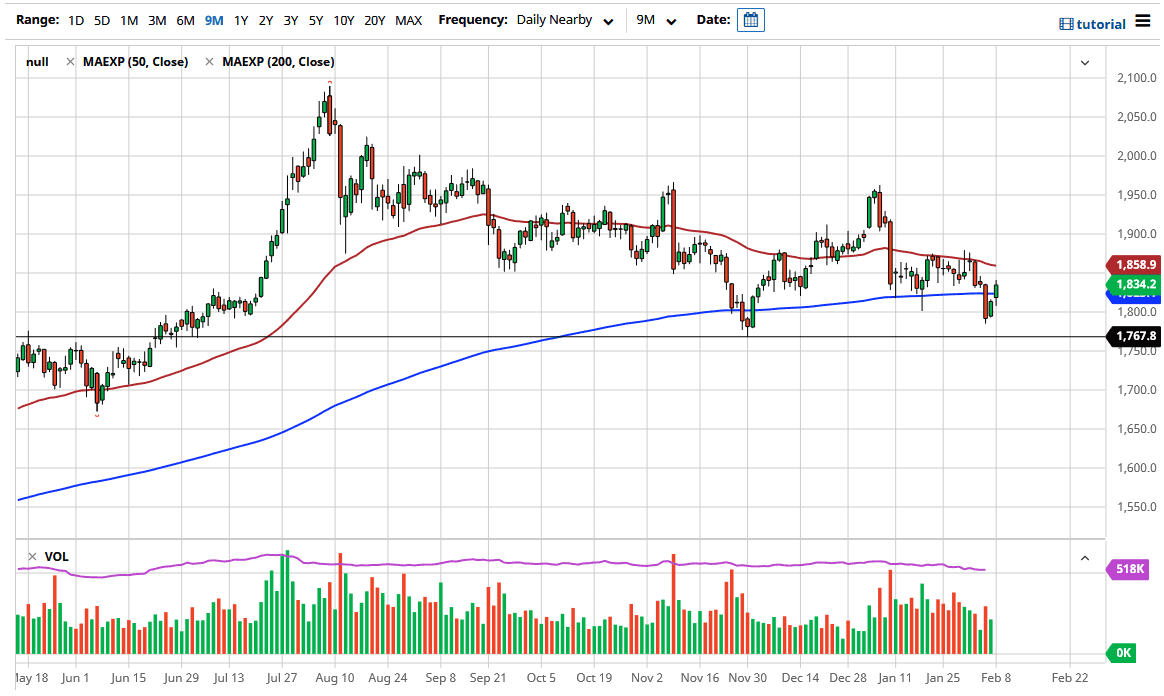

The gold markets recaptured the 200-day EMA during the trading session on Monday to kick off the week on a positive note. However, there is still significant resistance above, so I would not be surprised at all to see this market struggle to break out fully. The 50-day EMA above should cause a certain amount of resistance, but once we break above there, we could see the gold market look towards the $1900 level as a target. After that, you may be looking at a market that is ready to go to the $1960 level, as it was the scene of a rather significant sell-off.

To the downside, I still think we have plenty of support just below the $1800 level and then at the $1750 level, which I consider to be the “floor in the market” going forward. If we were to break down below that floor, that would be a very bad turn of events and could have this market falling apart. Rising bond yields are causing havoc when it comes to the gold markets, so do not be surprised if we see continued volatility.

Gold moves on multiple different factors, but right now it seems as if the market is willing to look more at the US dollar than anything else. If the US dollar continues to fall, that should be good for the gold market. This is much less a safety trade at the moment than it is a US dollar trade, at least from what I can see. Obviously, the scenario can shift, and recently we have seen a lot of action in the 10-year note in America, and that has caused a bit of a headache for gold traders. The one thing you can probably count on going forward will be a ton of volatility, as the markets are going from one narrative to the next when it comes to the US dollar, the reflation trade and inflation expectations. There are no real signs of inflation, at least not the metrics that a lot of people in the central banking world look at, so to think that inflation is imminent would be ignoring reality. However, it seems that there is a certain amount of expectation built into the marketplace, so that should continue to put a least a little bit of a bid into the gold market going forward.