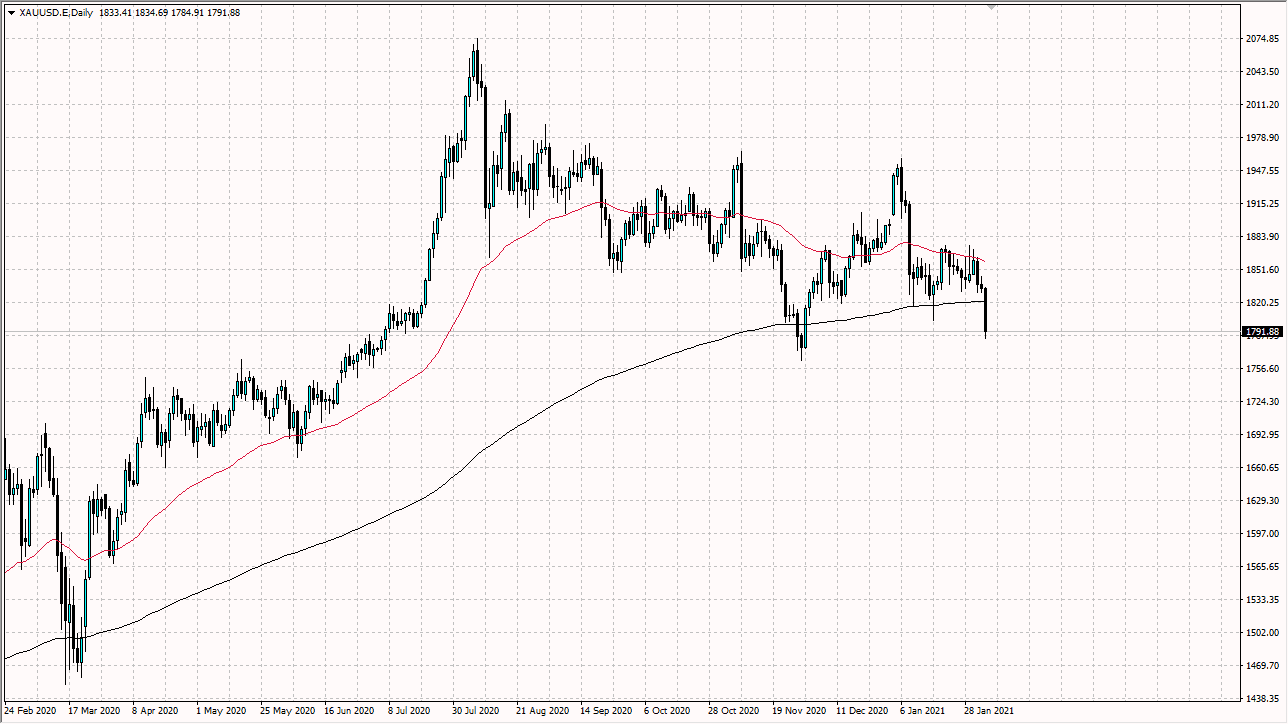

The gold markets have broken down significantly during the course of the trading session on Thursday to slice through the 200 day EMA quite handily. The gold markets are getting punished due to the fact that the US dollar has risen quite stringently, and then of course interest rates in the United States are rising. All this is toxic for gold, and as a result it is likely that the market will continue to press lower. If it does, there is a bit of a “line in the sand at the $1750 level.

Looking at the size of the candlestick for Thursday, I do think that there is fairly significant damage done to the gold market now, and therefore I do not necessarily feel comfortable buying at this point. This is a market that has been in an uptrend for a long time and I still believe that it is possible that we turn things around but clearly, we need to see some type of bounce from here. As for myself, I am not buying until we either turn around a break back above the 200 day EMA on a daily close or form some type of longer-term supportive candlestick. I have been buying in little bits and pieces as I anticipated a bit of a basing pattern, and that thesis still is possible, but that is the reason why I have been buying in little bits and pieces and not some large position.

If we do break down below the $1750 level on a daily close, that would open up the floodgates and even more short selling. At that point, I think that we could see an acceleration to the downside, and I think that gold would be falling apart. This is not to say that we will turn around eventually, but we are so far from inflation right now that I think the story and gold is starting to get very shaky to say the least. Keep in mind that Friday is Non-Farm Payroll Friday, therefore we could see a significant amount of volatility in the US dollar. That obviously could have a knock on effect over here, so it is deftly going to be something that you have to pay attention to. The market should have an interesting Friday, and I would probably stay away from it until we see how it closes.