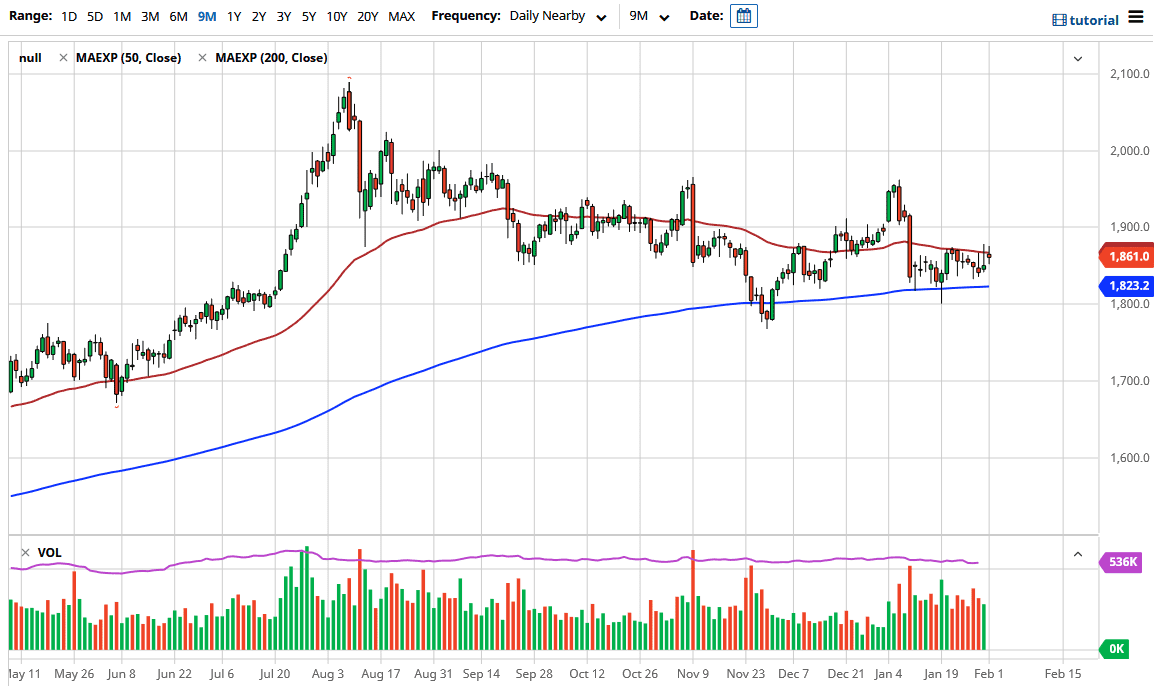

Gold markets fluctuated during the trading session on Monday, initially gapping higher due to the “knock on effect”, as the well-publicized retail attempt at causing a major short squeeze in the silver market rippled through the markets. After gapping higher, we went back and forth and, at this point, the 50-day EMA is acting as a magnet. If we can break above the top of the previous candlestick though, that is a very bullish sign, perhaps reaching towards the $1900 level.

To the downside, the 200-day EMA would offer a significant amount of support near the $1825 level, and I also believe that there is plenty of support underneath there as well. After all, the gold market has been bullish over the longer term, and now we are trying to form some type of basing pattern. The $1800 level I believe is massive support, and I think that support extends down to the $1750 level as well. It is not until we break down below that level that I would be truly concerned about the overall trend of gold. There are arguments to be made in both directions, so let us take a look at this.

The first thing that I think has a major influence on this market is what happens with the US dollar. The US dollar falling should help gold, as it is priced in that currency. The gold market does have a negative correlation over the longer term, but that does not necessarily always play out. There are times where gold and the US dollar can both grind at the same time to the upside due to a safety trade.

The next thing that I will be paying attention to is the yields coming out of the United States, due to the fact that it can cause strengthen the US dollar. At this juncture, the 10-year note is going to continue to be something worth paying attention to, because it will certainly be toxic to gold if it continues to see yields rise over the longer term. The overall attitude in this market has been sideways for several weeks, but I think we are getting to the point where we will see a move rather soon. Waiting for an impulsive candlestick is what I will be doing, and I will simply trade in that direction.