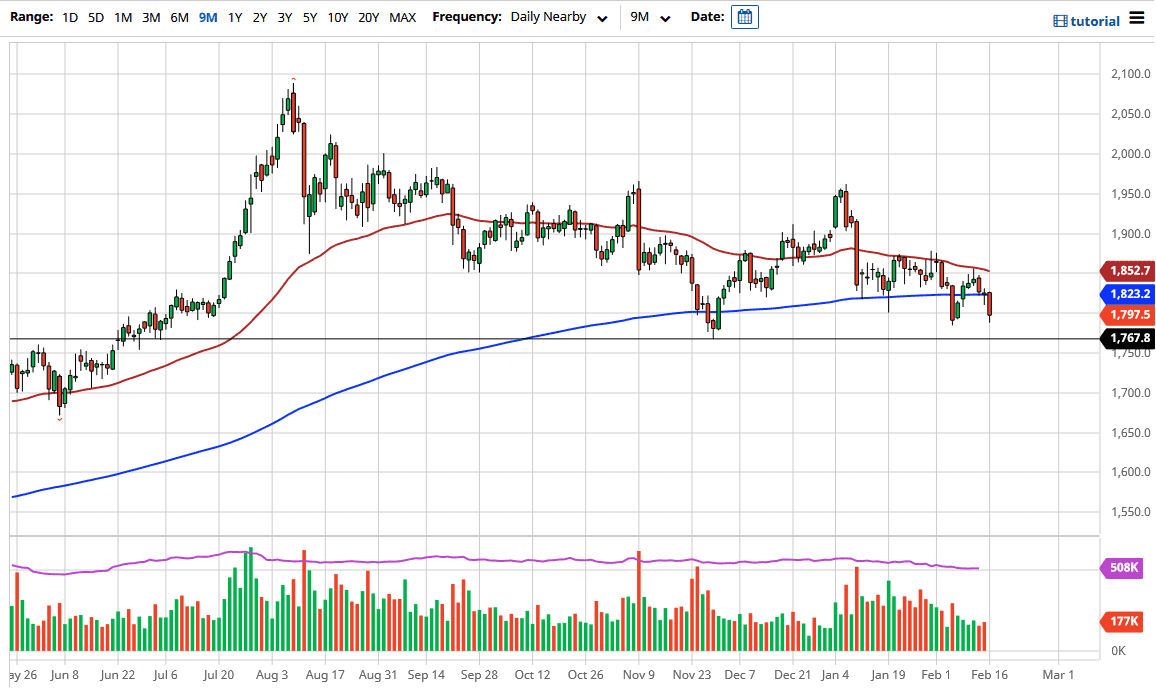

Gold markets crashed into the $1800 level and below it during the trading session on Tuesday, as the interest rates in the 10-year note climbed in America. This is very toxic for gold, and it is continuing to cause major problems for those who are bullish of gold. At this point, as long as we stay above the $1750 level, we have a chance for the market to show signs of forming some type of base. The market will fluctuate based upon interest rates, and it should also be noted that the US dollar strengthening and falling is continuing to be moved around by the same thing. In other words, we have a storm ahead of us when it comes to volatility.

Looking at the size of the candlestick, you can see that we had significant selling, but it is also worth noting that we did not form a new low. In other words, there is a lot of pressure on the gold market, but it has not broken quite yet. If and when it does, then I think gold is going to drop several hundred dollars, because it would be such a major breakdown. We have had a lot of issues, and if you are going to cheat gold you need to keep an eye on that 10-year note. If prices start falling - driving yields up - then gold is going to be in serious trouble. The next level is the 1.30% area in the 10-year yield that could be tested. If yields drive higher than that, gold is going to be hammered.

To the upside, the first barrier would be the 200-day EMA at the $1823 level, and then the 50-day EMA just above the $1850 level. There is a lot of noise above, but there is a ton of support underneath. In other words, I think you are looking at short-term back-and-forth day trading more than anything else if you truly feel the need to trade this market. If you are a longer-term trader, it is only a matter of time before inflation shows up, but central banks have been trying to cause that for the last 13 years. If and when it finally does, gold will take off, but right now we have no signs of it.