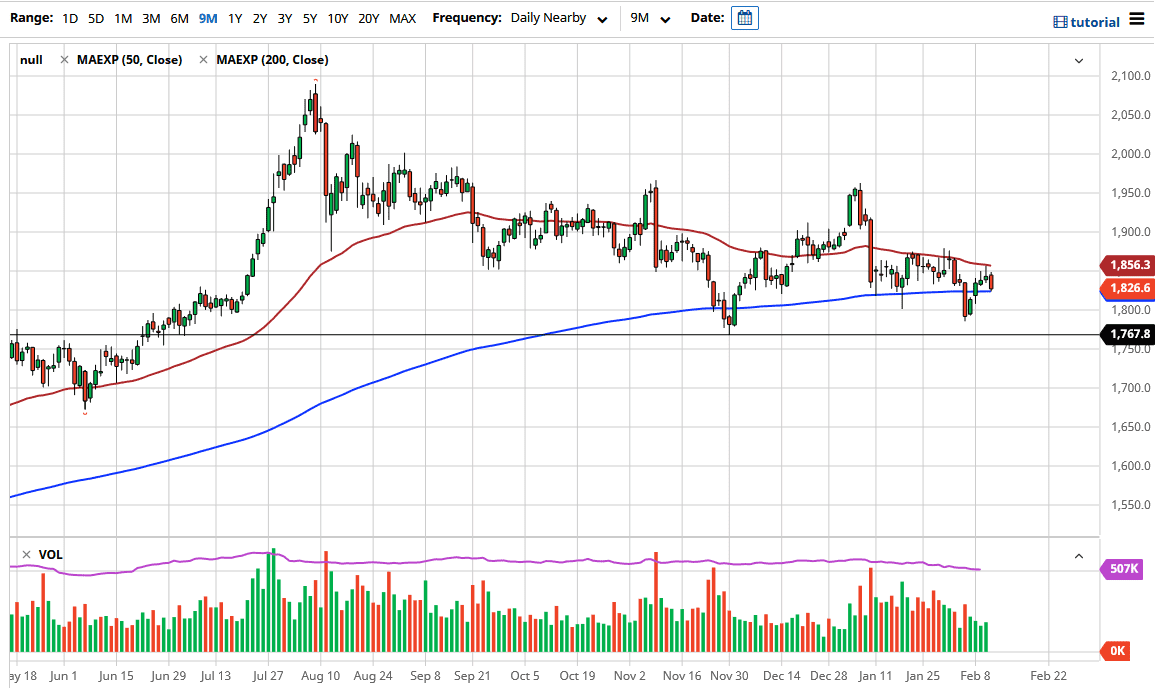

Gold markets broke down during the trading session on Thursday to reach down towards the 200 day EMA. The markets had formed a couple of shooting stars in a row, so it is not a huge surprise to see that the market fell like it did. Having said that, we now will probably go looking towards the support level in the $1800 level again. The 200 day EMA of course is going to cause some noise, but it certainly looks at this point in time that we are going to see noisy behavior more than anything else. Furthermore, it is worth noting that the most recent high was lower than the one before it.

To the downside, if we do break down, I think that we could go looking towards the $1750 level. That is an area that should offer plenty of support as well, and if we can break down below there then the gold market will probably fall apart. Keep in mind that the gold market is highly sensitive to the US dollar but perhaps even more importantly is sensitive to the idea of higher interest rates in America. The 10 year note continues to cause some issues, but at this point in time I think gold needs to build up a bit of a base, and it certainly looks a bit anemic. I think longer-term gold does rally significantly, but we are nowhere near inflation right now so that does not help the situation.

Ultimately, I think that if we can break above the 50 day EMA traders will jump in and try to push this market towards the $1900 level, possibly the $1960 level. Breaking above that level then allows gold to go back to the 2100 level, but I think we are a long way from seeing that happen. After all, we have yet even make a “higher high” from the recent selloff. I am not a big fan of shorting gold in general, because that is the same thing as buying the US dollar most of the time. In other words, there are easier ways to do a short gold position, so ultimately this is a market that I think will find a reason to go higher but right now are still kind of looking for it.