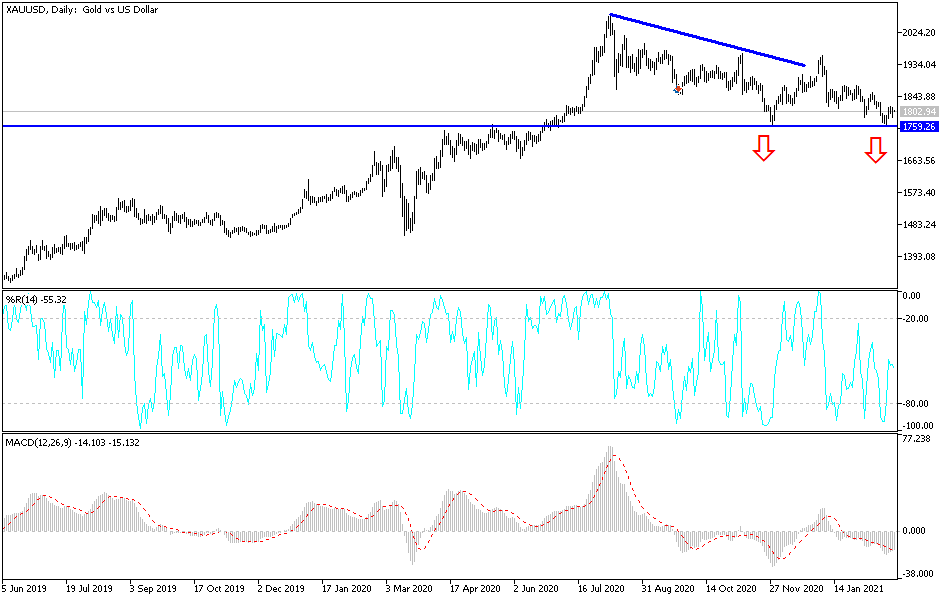

Gold markets initially fell during the trading session on Wednesday only to find support underneath and bounce towards the $1800 level. The hammer is a bullish candlestick, so if that is to be believed, if we could break above the top of the range for the session of the previous hammer, the market should go looking towards a challenge of the 200-day EMA. Breaking above that level could open up a move towards the $1850 level, possibly even the $1875 level.

On the other hand, if we turn around and break down below the bottom the hammer, then I think we need to start thinking about the $1750 level, an area that I think is a massive amount of support just waiting to happen. We did bounce from that area recently, so if we were to break down below it, that could be very bad news for gold. Interest rates in the United States have been rising, which causes problems in the gold market due to the fact that the storage costs of gold make it a negative yielding investment. On the other hand, you can simply clip coupons when it comes to bonds in order to get paid. Obviously, the higher the interest rates, the less attractive story and gold would be.

I think what we are going to see in the short term is a lot of volatility and choppiness, as we continue to bounce back and forth between the idea of higher interest rates in the 10-year note, and fear around the world when it comes to the global outlook. Yes, a lot of people are banking on the “reflation trade”, but that tends to help silver more than gold as silver is an industrial metal, while gold has much less industrial use. As long as real yields start to look like they are rising, I think gold will continue to struggle. That does not necessarily mean that it has to break apart, but I think we are essentially stuck and waiting for some type of driver to finally get moving for a bigger play. In the short term, I would be very cautious about getting into huge positions right now. Technically speaking, we could be forming a larger base to try to rally again, but we need to see some type of impulsive candlestick form in order to make sense of that theory.