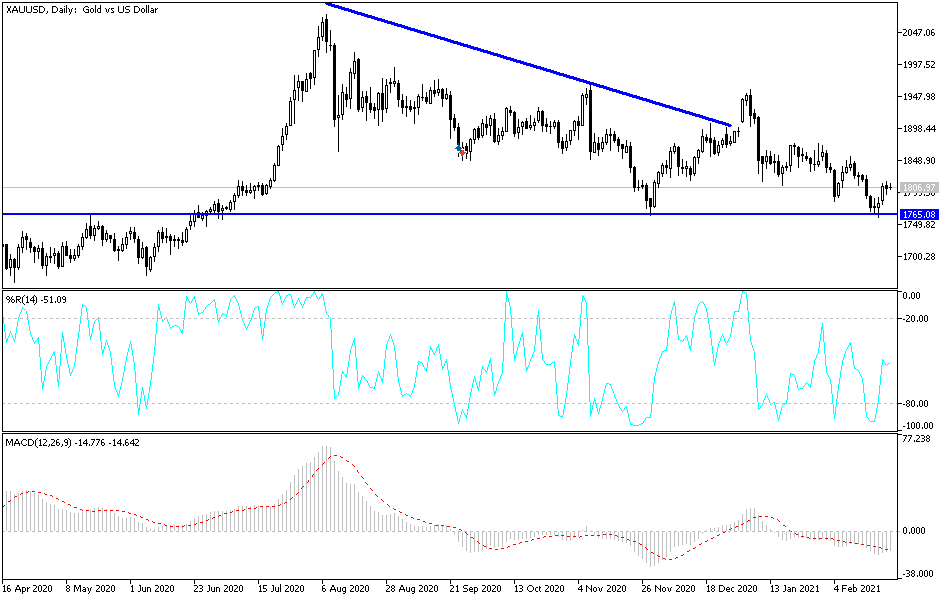

Gold markets initially fell during the trading session on Tuesday to reach down below the $1800 level. The $1800 level is a large, round, psychologically significant figure, and the fact that we have bounced from there is the first sign of some type of continuation on a potential bounce. The bounce happened just above the $1750 level, which is a major area of support on longer-term charts, so we should pay close attention to it. If we were to break down below there, then it could wipe out the overall uptrend, so hanging onto the market in that general vicinity was crucial.

One of the biggest drivers of gold going lower has been the interest rates in the United States climbing on the 10-year note. As a result, people find it more palatable to simply clip coupons in the bond market than pay for the storage and transportation of gold. The market now has to deal with the 200-day EMA above that could offer resistance, so if we can break above there it is likely that we could go looking towards the $1850 level. That is an area which, if we break above it, the market will go looking towards the $1875 level.

The question now is whether or not we will just reach lower to find more liquidity, or if we will simply turn around and sell off. I think you need to pay attention to the 10-year note going forward, as rising rates continue to be kryptonite for this market, but if the rates start to fall, then that could give gold a bit of a boost. Regardless, there are multiple areas above that could cause some issues, so I think that even if we do rally, it is going to take significant effort to get above there. Longer term, I do think that gold eventually will take off to the upside, but at this juncture there is so much in the way of noise that you do not need to jump in and “be a hero” before everybody else. Simply wait for the market to make its decision and its move and follow right along. That being said, if we do get the market breaking back down below that $1750 level, there should be a “flush” lower, probably much more aggressively than people are expecting.