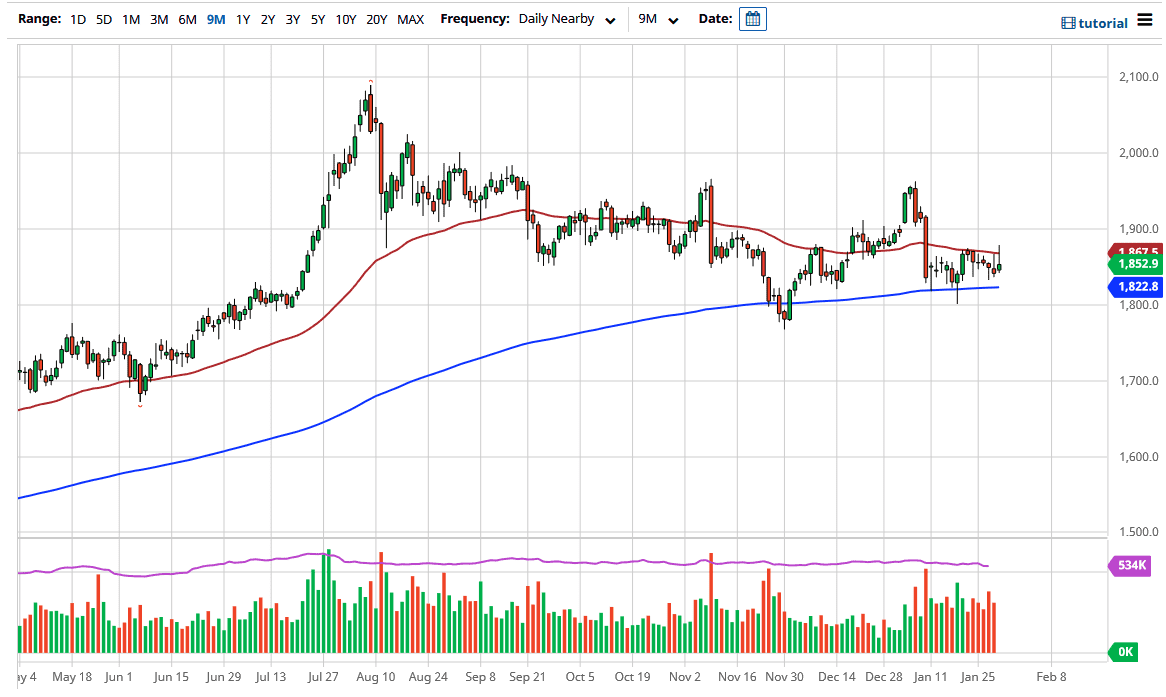

Gold rallied significantly during the trading session on Friday to break above the 50-day EMA, but gave back those gains to show signs of weakness. The market is likely to continue to bounce around in general, and gold will be at the mercy of the overall panic that seems to be jumping in and out of the market randomly.

Recently, we have seen interest rates in the United States spike a bit, which is toxic for gold. This is because you do not get paid anything to hold gold, while you do bonds. They both tend to serve the same purpose longer term: a way to protect wealth. Most traders do not want to be bothered with something that has no yield if they can avoid it. This is why gold suddenly will fall at times due to a strengthening US dollar, via the bond market.

The 200-day EMA sits underneath and offers a bit of support, so I do not necessarily think that we are going to break down anytime soon. I believe at this point we are simply looking at a market that is likely to continue hearing a lot of noise in general, and a tightening of the overall range. That means that we are going to make a bigger move sooner rather than later, but eventually what we will see is some type of impulsive candlestick that closes in one direction or the other with a long real body. That will be your signal as to where we go next. If we break to the upside, I think it is the $1900 level followed by the $1960 level that we will reach towards, but if we break down, we will probably go testing the $1800 level, followed by the $1750 level. Because of this, you need to be very cautious, but I favor the upside longer term, because I see a lot more embracing of the safety trade than anything else at this point.