Gold had a strong bullish start this week as it jumped to the $1812 level before settling around $1809 at the beginning of trading on Tuesday. The weakening of the dollar was a catalyst for the bulls to achieve this. US bond yields decreased slightly after reaching their highest level in one year. The US currency fell against other currencies as investors sought to buy currencies that have close ties to global commodity trade due to improved economic outlook.

Silver futures ended trading higher at $28.085 an ounce, while copper futures settled at $4.1410 a pound.

The US Economic Index rose 0.5% in January after rising by an upwardly revised 0.4% in December. Economists had expected the Headline Economic Index to rise by 0.3%, matching the originally reported increase from the previous month.

British Prime Minister Boris Johnson has presented a cautious four-step roadmap in Parliament to ease the country from a strict stay-at-home lockdown, with an initial timetable on June 21 to lift most restrictions if infection rates remain under control.

US Democrats are looking to pass the COVID-19 relief bill quickly. The US House of Representatives is expected to vote on the proposed package from President Joe Biden by the end of the week. Meanwhile, Federal Reserve Chairman Jerome Powell will testify before the Senate Banking Committee on Tuesday and the House Financial Services Committee the next day.

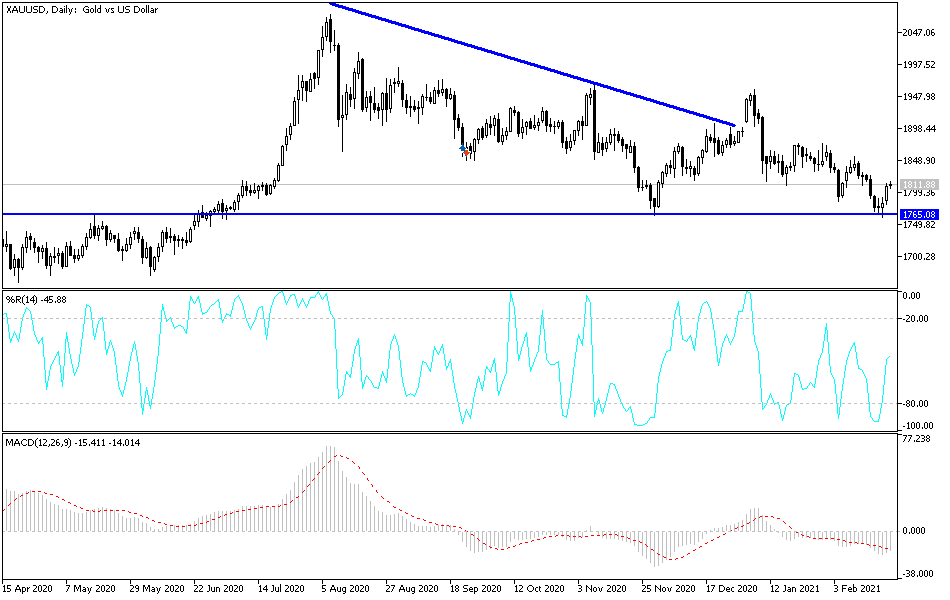

Technical analysis of gold:

Gold's stability above the resistance level of $1800 supports a bullish move towards the resistance levels at $1816, $1827 and $1845. These levels support the a return to bullish momentum. On the downside, according to the daily chart, the support level at $1760 will remain the most important for bears to control performance for a longer period. I still prefer to buy gold from every downside. The return of the global economy to pre-pandemic levels may require more stimulus plans and the use of exceptional tools and plans, which may support gold gains for a longer period.

The price of gold will interact today with the strength of the US dollar and the reaction to the announcement of jobs and wages data in Britain and inflation in the Eurozone. Gold will also interact with the reading of the US Consumer Confidence Index and the comments of US Federal Reserve Chairman Jerome Powell.