The price of gold has begun February by settling around the $1847 level, continuing its bearish trend. Despite this performance, many analysts are confident that the long-term outlook is still promising for gold. The price of gold decreased by 2.4% during January 2021, after an increase of nearly 24% in 2020. Analysts believe that the high yields of treasury bonds and the recent rebound of the US dollar, both of which depend on economic strength, are the two main factors in the short term that impeded gold prices.

Despite the optimism of the markets, there are still expectations that gold prices are expected to rise this year to more than $2000, and to continue moving towards new record levels by the middle of the year, in light of expectations that US President Joe Biden and Treasury Secretary Janet Yellen will "stand behind their rhetoric" and "provide stimulus in big hikes." These are strong factors for gold in the short and long term.

Janet Yellen called again last Friday for a swift passage from Congress on the Biden administration's $1.9 billion coronavirus relief package, saying that this measure is necessary so that Americans do not lose the ability to meet their basic needs such as shelter and food. Biden's coronavirus relief plan includes cash payments to Americans. Currently, the proposed US President’s plan offers headwinds to gold prices, as the Biden administration is likely to use financial tools to stimulate the economy, which means that debt levels will remain high and rise, which could be positive for gold in the long term.

The long-term debt of the US government and inflation levels are likely to be the "strongest factors" affecting the price of gold in the coming months.

Since the beginning of trading this year, the price of gold has witnessed unstable but mostly downward movements. Any decline in the price of gold may be an opportunity to buy again, as the continuation of the coronavirus pandemic will increase the opportunity for the yellow metal to rise continuously. Therefore, the prospects for gold will be the continued launch of COVID-19 vaccines and their impact on the global economy.

We noticed the start of a “wave of enthusiasm in the market” in late 2020 when the first COVID-19 vaccines were given, raising hopes for GDP growth and thus easing demand for safe havens like gold. Nevertheless, gold prices are likely to remain somewhat elevated during the first half of 2021, at around $1860, as “reality set in” that it would take at least six months for vaccination rates to reach a level that would accelerate the US economic recovery.

The price of gold may decline significantly in the third quarter to $1775 on average with the acceleration of GDP growth, then to about $1750 in the fourth quarter, and for the economic recovery of the United States of America, it will be gradual in the period from 2022 to 2023, which prevents the occurrence of a sharp drop in gold prices.

At the present time, the main factor that must be watched will be vaccination efforts. If vaccination rates increase faster than we currently expect, this will enhance economic prospects and further reduce the demand for a safe haven such as gold. On the other hand, the emergence of new variants of COVID-19 may threaten to impede progress, and thus the rush of investors to safe-haven assets such as gold.

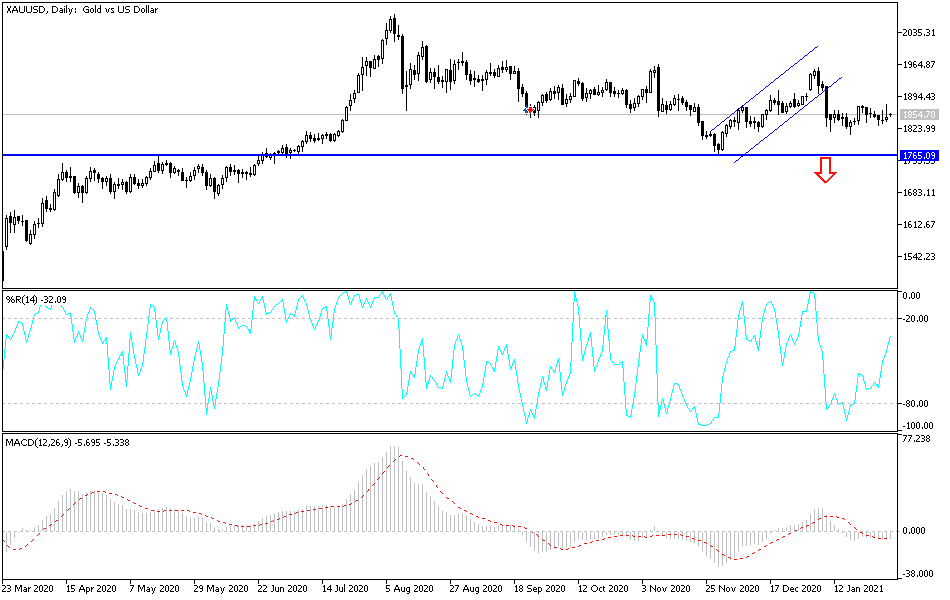

The most important support levels for the gold price today: 1838, 1820 and 1800.

The most important resistance levels for the gold price today: 1862, 1875 and 1900.