Gold is being sold amid the recovery of the US dollar, with gold falling to the $1830 level before settling around $1844 as of this writing. The price of gold continues to decline along silver, which is experiencing profit-taking after testing the psychological resistance level of $30. With the craze of retail trade subsiding, silver prices fell by more than 10% during one trading session after gaining about 9.3% on Monday to record the highest close in nearly eight years.

Feverish buying in global stock markets amid growing optimism about additional stimulus from the US and a vaccination program has weakened demand for the safe-haven yellow metal. The strength of the dollar also contributed to the decline in the price of gold.

Vaccination campaigns have picked up speed around the world, with millions already receiving their doses. In this regard, German Chancellor Angela Merkel said that a vaccine against the coronavirus was supposed to be offered to everyone in Germany by the end of September. Meanwhile, the World Health Organization reported on Monday that the number of new coronavirus cases worldwide had decreased for the third consecutive week. However, she urged countries not to slow down efforts to roll back efforts to fight the pandemic.

US stock markets hit record highs just two weeks ago, as technology stocks lifted major indices aggressively in hopes that more financial spending will revive economic growth and boost corporate profits. Risk appetite among investors was also boosted by the push for new US President Joe Biden to obtain nearly $2 trillion in additional spending and plans to stimulate a federal response to the epidemic. The rise came despite the entry of some major economies into recession and growth began to decline in the United States of America. Although the US economy continues to outperform its European counterparts, it is still saddled with an unemployment rate of 6.7%, with employers cutting nearly 140,000 jobs in December.

The concern among some investors is now that the stock market is overvalued, a downward correction is expected to be potentially destabilizing.

Chinese police have arrested more than 80 suspected members of a criminal group that was manufacturing and selling fake COVID-19 vaccines, including to other countries. In this regard, the official Xinhua News Agency reported that police in Beijing and Jiangsu and Shandong provinces have dismantled the group led by a suspect named Kong who was producing fake vaccines, which consisted of a simple saline solution.

The vaccines have been sold in China and other countries, although it is not clear which ones. The group has been active since last September, according to state media. Thus, Foreign Ministry Spokesman Wang Wenbin said in a daily briefing, "China has already informed relevant countries of the situation." China has a long history of vaccine scandals stemming from manufacturing problems as well as business practices. In 2016, police arrested two people responsible for a gang that sold millions of improperly stored vaccines across the country.

In response to recent scandals, China has reformed vaccine safety regulations and increased criminal penalties for those caught making counterfeits.

Domestically, many Chinese citizens did not trust local vaccines, and surveys previously showed that confidence in vaccines declined after scandals like the one in 2016. However, since the outbreak of the epidemic, confidence has been high. A total of 74% of respondents to a recent survey published in the Chinese business magazine Caixin said they would take a COVID-19 vaccine if it was available.

China has at least seven COVID-19 vaccines in the final phase of clinical trials, and it has one that has been approved for domestic use, produced by the state-owned company, Sinopharm. Chinese vaccine makers have seized the opportunity provided by the epidemic to take off into the world, as Sinopharm and other Chinese companies concluded deals or donated their vaccines to at least 27 countries around the world.

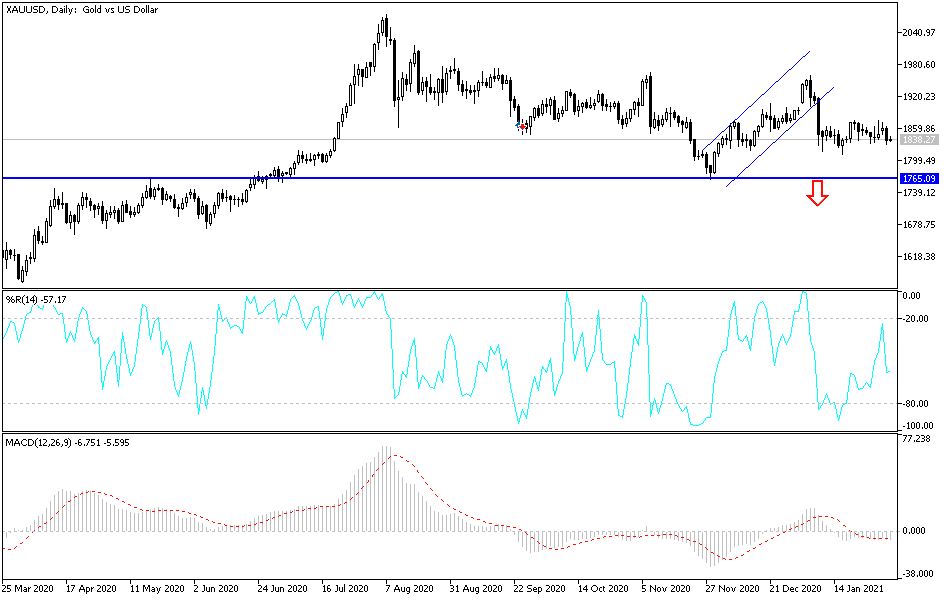

Technical analysis of gold:

With gold's recent decline, investors are waiting for the opportunity to return to buying, and we see that the support levels of $1829, $1817 and $1795 are the most appropriate to do so at the present time. The bulls will control the performance in the event that the price moves steadily above the resistance of $1877.

The price of gold today will be affected by the strength of the dollar, the extent of investor risk appetite and the market’s reaction to the announcement of the first US jobs numbers for this year. Passing US stimulus at any time will bring about a strong change in the market.