Despite the strength of the US dollar, the price of gold is trying to stabilize above the $1872 resistance level. Support for gold came from the sharp rise in silver prices due to frenzied purchases by retail traders. The US dollar gained amid doubts surrounding the imminent debate about additional fiscal stimulus by US policymakers and the potential impact on growth prospects from the introduction of the slow-moving vaccine rollout. The volatile equity markets have also contributed to the increase in demand for the US dollar.

Silver futures traded at $29.418 an ounce.

A report released by the Institute of Supply Management showed that the pace of growth in manufacturing activity in the US slowed more than expected in January. ISM said the Manufacturing PMI fell to a reading of 58.7 in January from a revised 60.5 in December. Economists had expected the index to show a more modest decline to 60.0. Construction spending in the US increased by a moderate 1% in December as the number of new homes offset the continued weakness in non-residential construction. The US Commerce Department reported that the increase followed a 1.1% increase in November. Last month's strength came from a 3.1% jump in spending on housing projects as money earmarked for single-family homes increased 5.8%.

While home construction was on the rise, there was a 1.7% decrease in non-residential construction, which had a decrease in hotel and motel construction and in the category that includes shopping centers. Spending on government projects hit by lower tax revenues rose 0.5% in December.

In an era of extraordinary interest rates, housing has been a star performer over the past year even as the COVID-19 pandemic has devastated other parts of the economy. Economists believe that the sharp divide between a strong housing sector and weak non-residential construction may narrow in the coming year as the country pulls out of the recession caused by the epidemic.

“We are looking for a gradual recovery in non-residential private investment as the recovery continues while we expect the pace of housing starts to slow down a bit,” said Nancy Vanden Houten, Chief Economist at Oxford Economics. She also said that she expected government construction to continue to be restricted due to tight government and local budgets. Construction totaled $1.49 trillion at a seasonally adjusted annual rate in December, up by 5.7% from December 2019. Residential construction increased 20.7% from December 2019 as spending on single-family homes increased by 23.5% while spending on apartment construction increased by 17.8%.

At the beginning of this week's trading, gold prices rose with the expansion of retail investor activity in their battle fueled by social media against Wall Street to push silver to its highest level in five months. Therefore, the price of silver increased by more than 10%, which helped gold prices follow suit. Silver is now the latest target after last week's retail wave saw the likes of GameStop (GME) and AMC Entertainment (AMC) shares in a major revolution for institutional investors.

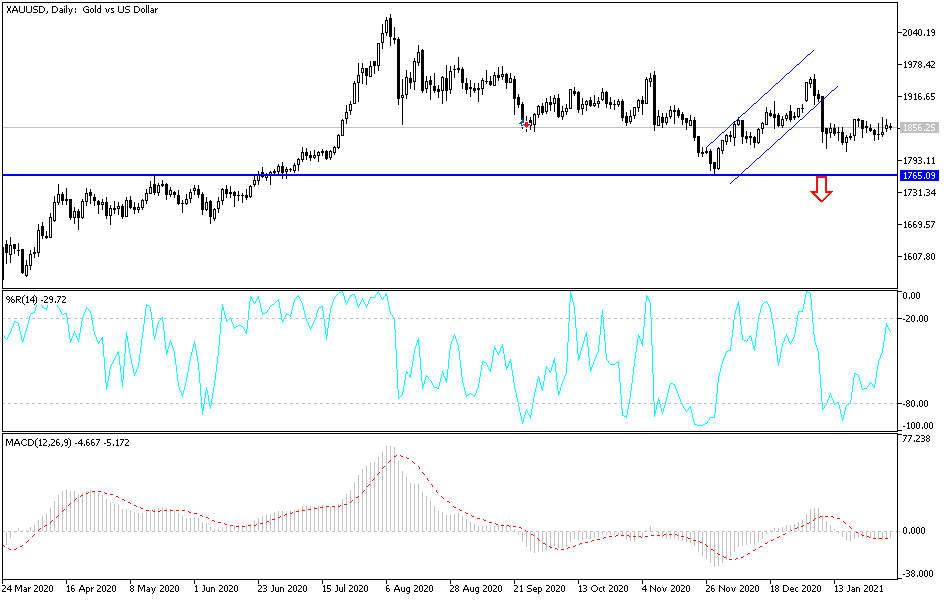

Technical analysis of gold:

On the daily chart, there is neutrality in the performance of the gold price with a bearish tendency in the event that it breaks the level of $1840. The bears would then target stronger support levels at $1827, $1810 and $1785. Any chance of a decline in the gold price will be an opportunity to buy again. The elimination of the coronavirus will take more time and the global economic recovery will not happen overnight. Accordingly, safe havens, including gold, will remain the only way for investors to face developments. On the upside, the bulls are still eyeing the psychological resistance at $1900, and at the present time, the bulls have crossed the resistance barrier of $1885 to assert control.

The price of gold today will be affected by the strength of the dollar, the extent of investor risk appetite, and global vaccination rollouts.