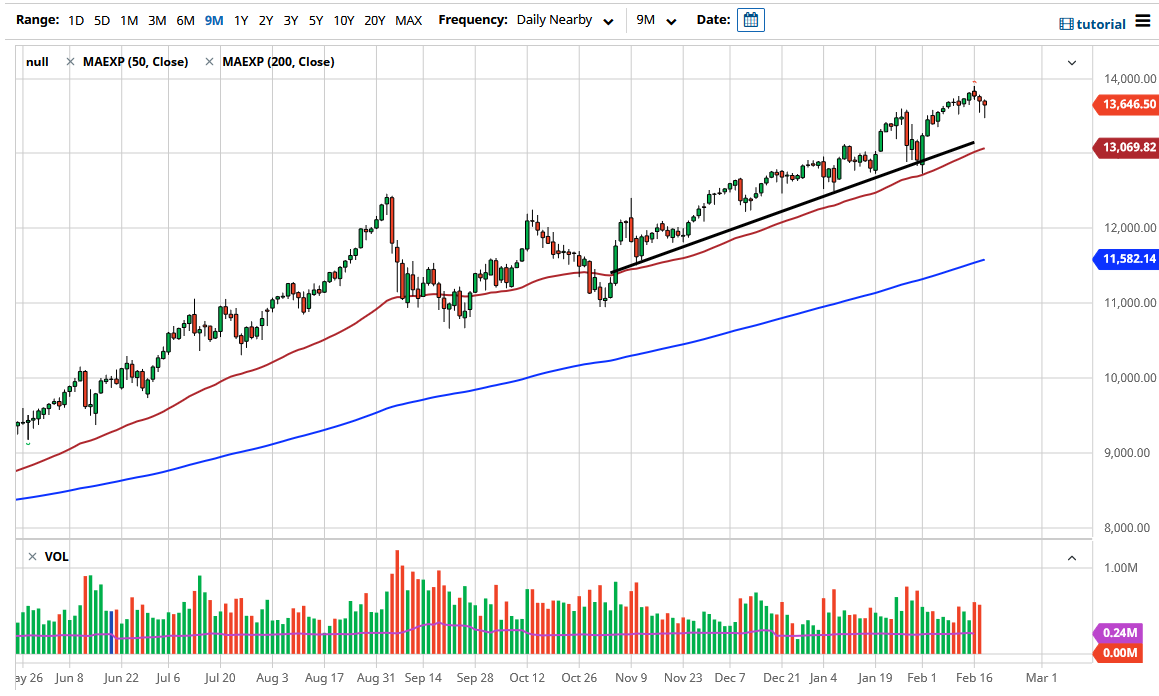

The NASDAQ 100 has broken down significantly during the trading session on Thursday to turn around and form a massive hammer. The size of the hammer is somewhat impressive, just as the trend has been. The last couple of candlesticks have shown just how bullish this market is, and therefore I think it is only a matter of time before we go looking towards the 14,000 level above. Looking at this chart, if we break down from here, I think that we probably go down to the uptrend line, as well as the 50 day EMA if we get a significant amount of a spike in the yield. That being said, I think it is only a short-term blimp and it is likely that we will find plenty of reasons to go higher, if for no other reason than momentum.

To the upside, I believe that the market is probably going to go looking towards the 15,000 level, which is a large, round, psychologically significant figure. All things being equal, this is a market that has a handful of companies that everybody seems the low, and therefore it makes sense that the big names continue to push this market yet again.

In general, we are still in a nice up trending channel which of course is the main driver of the market from a technical analysis standpoint, so this is something worth paying attention to. In general, I think that this is a market that will eventually find one reason or another to go higher because that is how this has been for ages and the liquidity been forced in the market continues to have people go out on the risk spectrum in order to jump into the NASDAQ 100 and stocks in general.

I do think that we will continue to see a lot of choppy behavior more than anything else, but most certainly with an upward bias. That upward bias has been a main theme in this market, so with that being said I believe that the behavior that we have seen of the last 13 years is going to continue in the short term. We do look a little bit tired, and we should see quite a bit of volatility, but at the end of the day there is no way to actually short this market. If you were to find a selling opportunity, you are probably better off sitting on the sidelines.