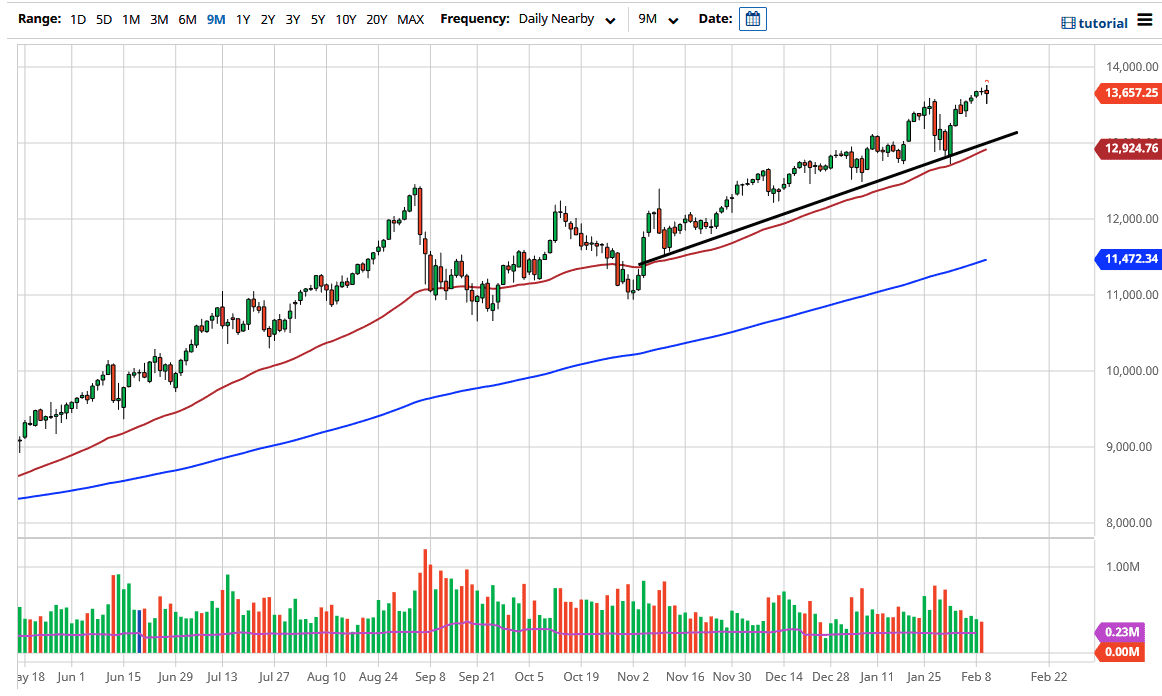

The NASDAQ 100 fluctuated during the course of the trading session on Wednesday as we are now starting to get a little over-stretched. It is worth noting that we did recover quite a bit of the losses, which is a good sign. To the upside, I think the market will eventually go looking towards 14,000 level, but it may take a bit of a dip in the meantime in order to get there. Furthermore, I think that there is a lot of choppiness in general waiting for the market, but we are in an uptrend that continues to be very strong.

Underneath this recent trading action, we have a lot of support in the form of an uptrend line and the 50-day EMA. In general, this is a market that will continue to find people jumping in to pick up the value that occurs on pullbacks. The shape of the candlestick even says that same thing, that there are plenty of buyers underneath that will continue to jump in. After all, the NASDAQ 100 continues to be driven by a handful of major technology companies, the same stocks that everybody jumps into every time they dip. The liquidity that has been forced into the stock market will continue to go forward, as Jerome Powell even stated during the day that the rates in the United States will continue to be extraordinarily low, which the Federal Reserve is stuck doing. The only thing they can do is loosen rates and monetary policy, because the minute that they tighten anything, we get what is known as a “taper tantrum” in the stock markets. The last time they tried to even remotely tighten monetary policy, the market fell apart. This is all about Wall Street training Federal Reserve members to stay away from that tightening cycle, so that everybody can continue to push the market higher. Yes, I think there is a day of reckoning eventually, but we are nowhere near that right now, so there is no point in trying to fight what is a runaway train. I have no scenario in which I'm willing to short the NASDAQ 100, but if we did break down, I might be convinced to buy puts somewhere below the 50-day EMA.