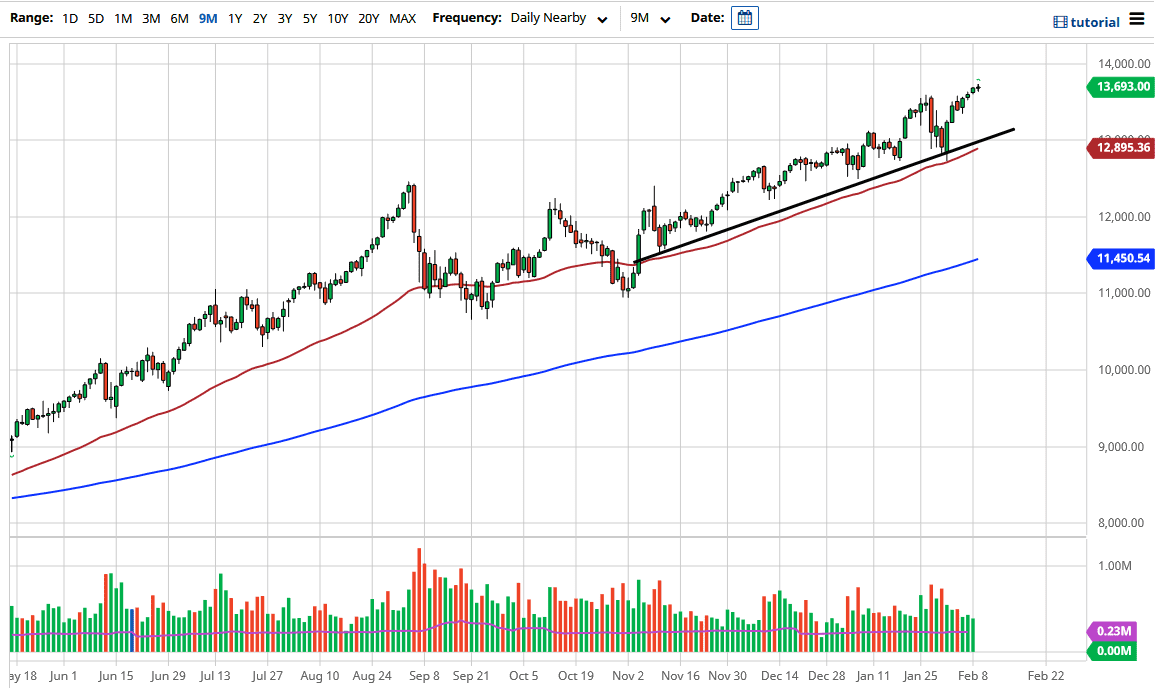

NASDAQ traders continue to be bullish and see reasons to buy the market. This is all about liquidity in the long run, but people have jumped all over Tesla due to the buying of Bitcoin. Because of this, the market is likely to see more of a “buy on the dips” type of scenario. At this juncture, it looks likely that we are going to go looking towards the $14,000 level. This is a market that continues to see liquidity drive prices higher more than anything else.

I do believe that we are due for a pullback, and you could make an argument for the fact that we are running out of momentum. However, if we do get that pullback, it is very likely that it will simply end up being a buying opportunity before all is said and done. I think that is especially true if we get closer to the 13,000 level. When you look at the previous consolidation area, the market has a measured move looking towards the 15,000 level over the longer term. Furthermore, it is a large, round, psychologically significant figure that a lot of people will pay attention to.

If we were to break down below there, then we would probably slice through the uptrend line and the 50-day EMA. That would be an event that people would pay close attention to, but I think it would simply offer yet even more value. Do not get me wrong; we are clearly overbought and looking at a scenario in which a rapid pullback could occur, but let us not forget that the Federal Reserve will step in to pick up the NASDAQ and Wall Street in general. I anticipate that if we do get some type of liquidity event or something along those lines, it is very possible that the market will eventually have the breakdown that so many people are looking for. Value would then be offered, and then it is likely that fund managers would pile in and take advantage of a market that seemingly always goes higher. At this juncture though, it is difficult to buy this market at these highs, but clearly you cannot be a seller.