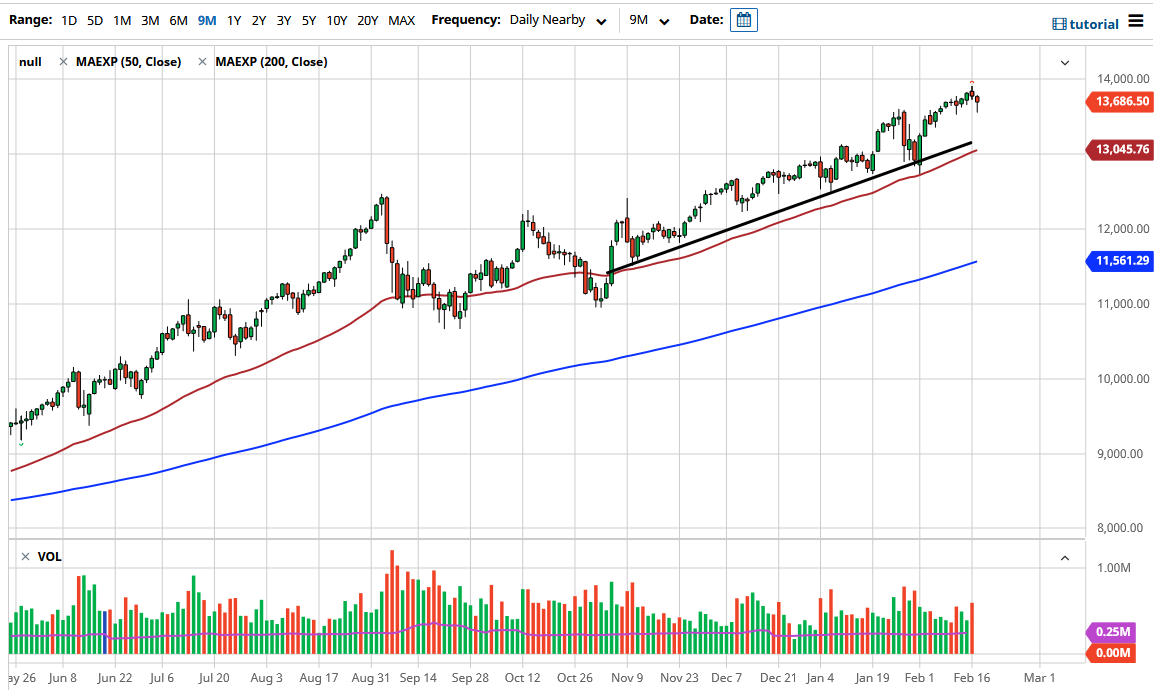

The NASDAQ 100 got hit rather hard during the trading session on Wednesday but then turned around to form a hammer as it looks like we are trying to continue to go towards the 14,000 level. The initial scare was that the interest rates in the 10-year note started to rise again, but that was rebuked and the next thing you know, we started to see bullish pressure come back into the markets in general. I think it is only a matter of time before we have value hunters coming back into the market.

Looking at the shape of the candlestick, you can see that there was a huge push against the selling pressure, and it does bode well for a move to the upside. The 14,000 level is the next headline number that people will be looking towards, but I think the longer-term target is closer to the 15,000 level. This is a market that may go looking to go sideways more than anything else, as we have already seen that the market does not want to break down. If that is the case, then we will simply be “killing time” to work off some of the froth.

The NASDAQ 100 is driven by all of the same stocks that Wall Street wants to buy, including Facebook, Microsoft, etc. Because of this, I do not have any interest in shorting this market, and I think that value hunters will continue to jump into this market all the way down to the 13,200 region where the uptrend line and the 50-day EMA are both coming into the picture. Because of this, I think it is only a matter of time before you see some type of supportive candlestick that we can take advantage of. Nonetheless, if we break above the 14,000 level, then we could go looking towards the 15,000 level after that. I would be a buyer above 14,000 as well as a buyer of dips and have no interest whatsoever in shorting this market as it is like a freight train, and just as dangerous to step in front of. With that in mind, I would look for some type of negative position to be fulfilled by purchasing puts, not actually shorting. At this point though, I am not even interested in that.