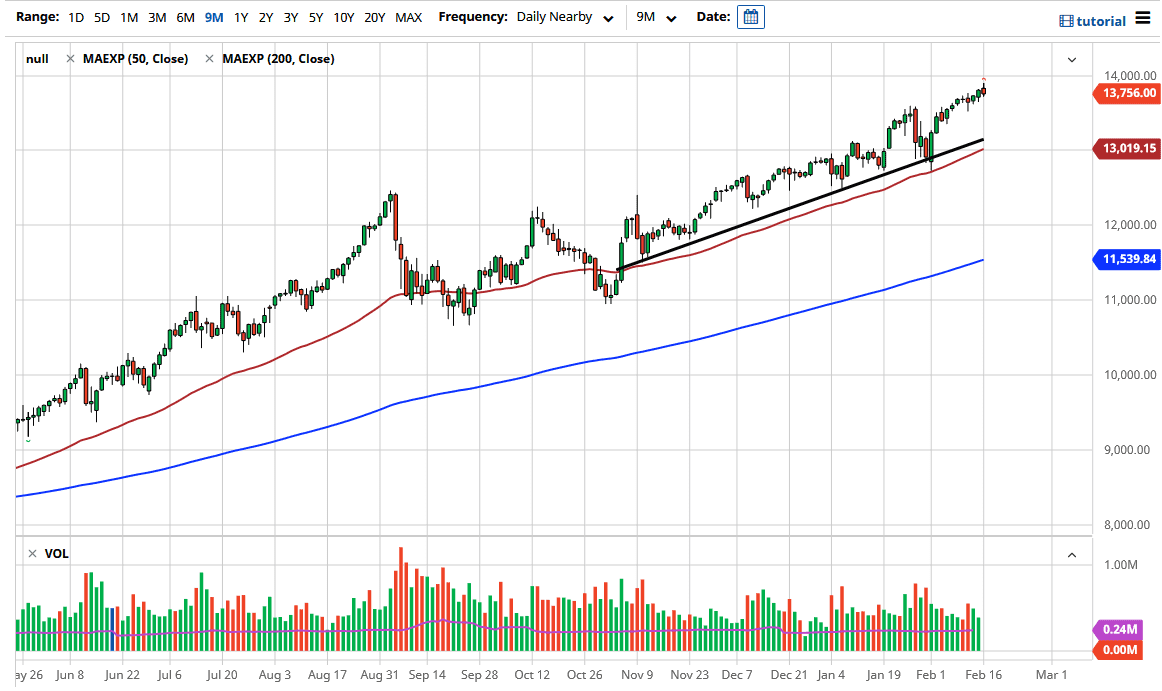

The NASDAQ 100 initially tried to rally during the trading session on Tuesday but found enough resistance to turn things around and fall after bond yields in the 10-year note reached the 1.30% level. That has people looking at the market as one that is perhaps threatened, and a certain amount of portfolio shuffling has to happen after something like that occurs. I also recognize that the 14,000 level above should be resistance, and therefore I think a lot of people will look at that as a significant psychological level that should be an area for profit-taking.

As I mentioned from the S&P 500 chart, you can see that we had a strong handful of days followed by five candlesticks, which are looking less impulsive recently. That does not necessarily mean that we need to break down significantly, just that perhaps we are a bit stretched. I think a good pullback makes sense, and a lot of people will look for opportunities underneath. I suspect that the 13,500 level will attract a certain amount of attention as will the 50-day EMA, right along with the uptrend line on the chart that could come into play also.

If we do turn around and break out above the 14,000 level, we will get more of a “blow off top”, which would be the least likely sustainable move, because the last thing you want to see is a runaway market. I do think that eventually we will go to the 15,000 handle, but it is much more desirable to see the market go back and forth as the inner show will not be run out too quickly.

Keep in mind that the NASDAQ 100 is highly influenced by the technology companies that allow people to work from home and all of the same household names that Wall Street loves anyway. With this, I think that they will continue to go to the same companies as the groupthink is strong right now, and that will continue to be how we see the market trade. Furthermore, the liquidity measures being taken by the Federal Reserve will continue to have people looking for growth in some of the riskier tech stocks. I have no interest in shorting, at least not until we break significantly below the 13,000 handle.