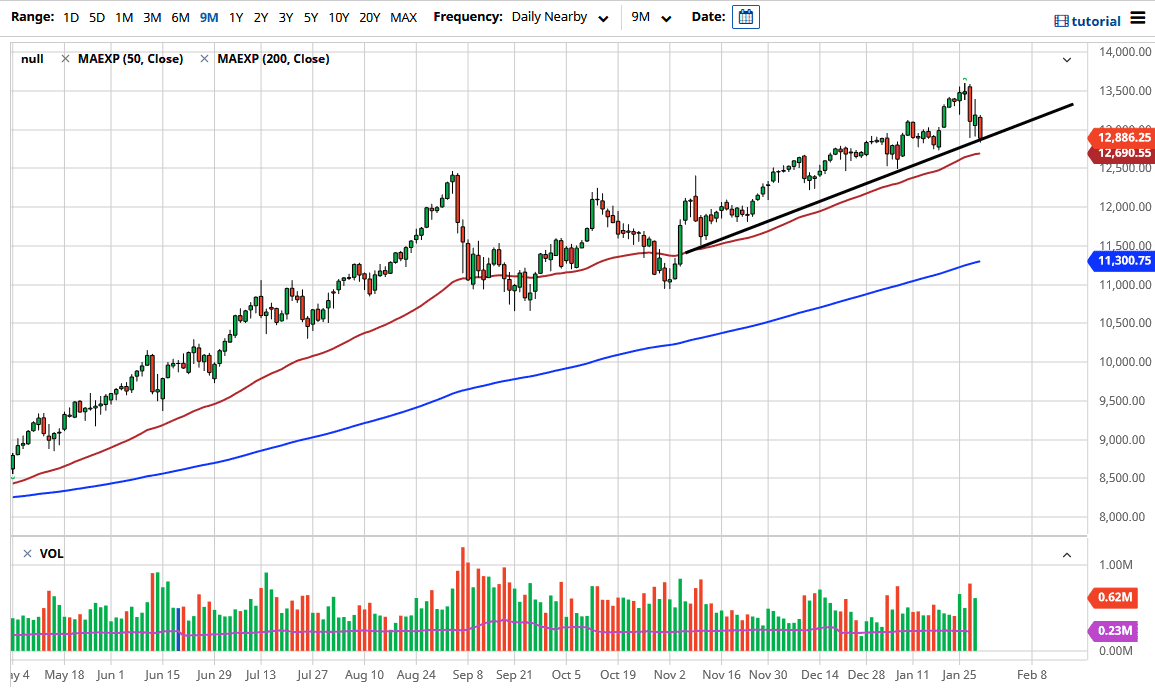

The NASDAQ 100 fell rather hard during the trading session on Friday to test a major trend line. However, this trend-line is an area where one would expect bits and pieces of support, as we have seen over the last couple of days. The market has been shocked by the options markets and the retail traders out there breaking down hedge funds. I do not read too much into this, because it cannot go on much longer.

When you look at the trend line, you also see that the 50-day EMA sits underneath it, and it is likely that it would continue to support the overall attitude of the market. In general, this is a market that will continue to suffer at the hands of the latest rumors of stimulus as well, and we are in the midst of earnings season. What I find interesting is that the market broke down despite the fact that we had seen monster earnings from companies like Microsoft, which typically would send this market straight up in the air. This tells me that we are becoming disconnected from the fundamentals again, and therefore everybody is focusing on this Wall Street Bets nonsense going on out there. Yes, it does threaten a few brokerages, but at the end of the day somebody is going to step in and fix the system. They always do.

I would like to see a buying opportunity on a supportive candlestick. Furthermore, I think that if we get some type of good news on the stimulus front, it would not surprise me at all to see this market turn around and rally to start the week. If we do break down, I anticipate that the 50-day EMA and the 12,500 level both could cause a significant amount of support also. In other words, I am not panicking, despite the fact that the last couple days have been rather drastic. When you look at the longer-term chart, you can see that they are merely a blip on the radar and therefore not something to be overly concerned about quite yet. To the upside, I believe that the market probably will go looking towards the 13,500 level, and then possibly the 14,000 level based upon my longer-term projections.