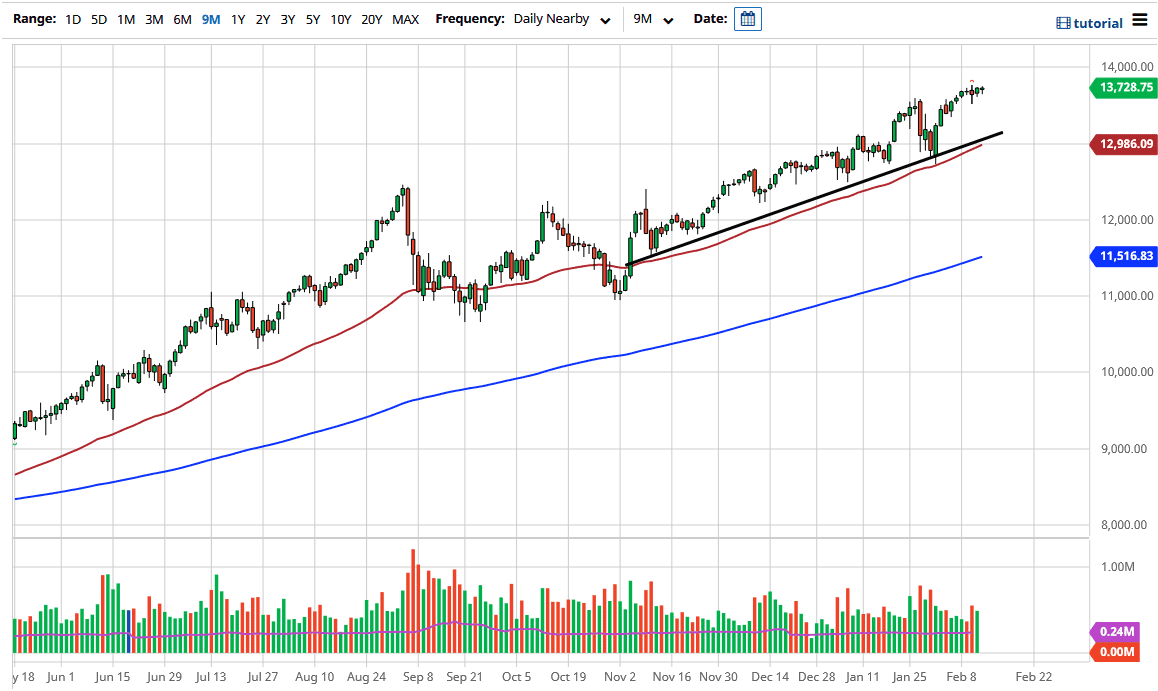

The NASDAQ 100 continues to go sideways as the Friday candlestick was less than impressive. We have been going sideways all week, even though we did try to pull back significantly during the day on Wednesday. By breaking down the way we did and then recovering, this tells me that we are more likely to see the market go sideways and kill time instead of pulling back to find more value. You can work off froth in a market by either going sideways or dipping, and right now it looks like we are trying to go sideways.

Keep in mind that the market is paying attention to all of the stimulus that is coming out, and I do think that we will continue to see a lot of people pile into the same handful of stocks that they have been for the last couple of years, due to the “work from home” trade, and the idea that the Federal Reserve is going to come in and lift up the market anytime it falls. Beyond that, we have a massive amount of stimulus, so I think all of this coming together gives us an opportunity to buy-and-hold or look at the market as one that you should look at through the prism of value every time it drops. I believe that the 13,250 level is massive support, right along with the 50-day EMA and the uptrend line. I have no interest in shorting this market anytime soon, or maybe even forever at this rate.

I think that this market not only will go looking towards the 14,000 level above but will eventually go looking towards 15,000, which is a large, round number that people will be paying close attention to. Breaking above there opens up another leg higher, but right now I am going to focus on the next 1000 points or so, which should in theory at least be to the upside. If we do start to break down, then I will be a seller, but I will be looking at buying puts in order to take advantage of downward pressure and the ability to limit my losses. After all, the market has broken down a few times over the last 13 years or so, and quite violently. However, as the market is tilted to the upside most of the time, it simply easier to be “long only.”