The NASDAQ 100 fluctuated during the trading session on Friday after the jobs number came out a bit disappointing. This is a market that I think continues to hear a lot of noise, but there are plenty of market participants willing to jump in and pick up dips every time they occur. Longer term, I think this is all about volatility and liquidity, as markets continue to get pushed higher due to the fact that “there is no alternative.” In a low to zero interest-rate environment, it is difficult to imagine a scenario in which traders are going to be looking for other assets, especially as the Federal Reserve goes out of its way to lift the markets.

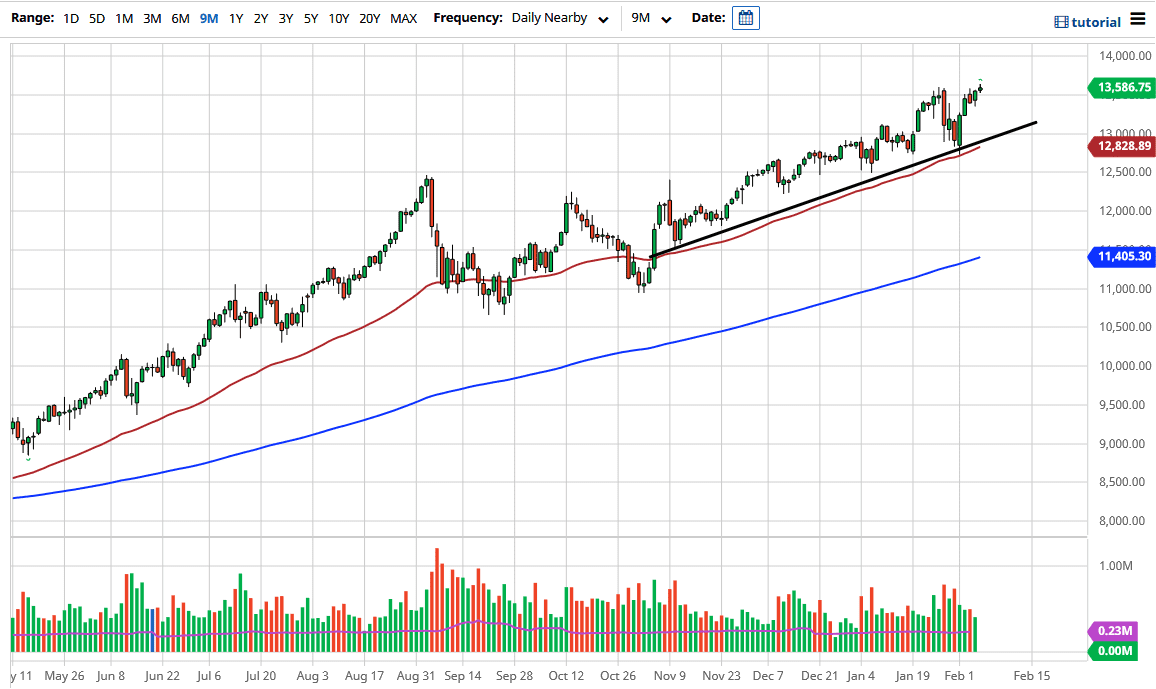

As long as we have liquidity, people are going to be looking towards short-term pullbacks as value, and I think based upon the structure of the market we are probably going to break out to the upside and go looking towards the 14,000 handle. To the downside, the 13,000 level will offer support right along with the uptrend line, and the 50-day EMA that sits right next to it. The NASDAQ 100 will continue to see inflows due to the fact that there are a handful of stocks that Wall Street continues to pile into, and they drive up the value of the NASDAQ 100 as they are the most heavily weighted. Simply put, there is no way to short this market unless you are looking to lose money.

Even if we break down below the 50-day EMA, it is probably only a matter of time before the buyers come back into pick this market up, especially near the 200-day EMA, which is currently as low as 11,400. In other words, if we do break the trend line, simply wait for value that we can take advantage of as Jerome Powell has already proven more than once that he is going to step in and protect Wall Street from anything remotely close to a loss. I know this sounds cynical, but it has been the case over the last 13 years through three different Federal Reserve Chairmen. If the US dollar were to turn around and start selling off, then that would also help stocks.