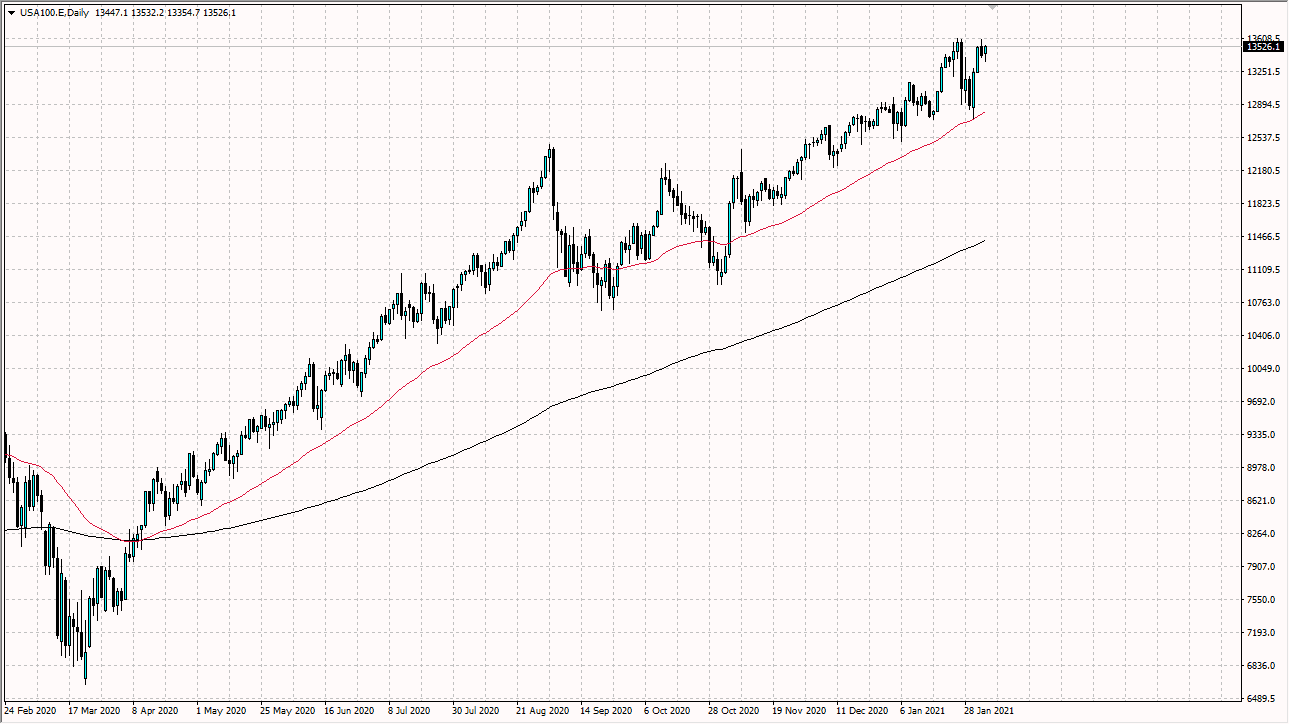

The NASDAQ 100 initially pulled back just a bit during the trading session on Thursday only to turn around and show signs of strength again. The market has been in a strong uptrend, and at this point I think we are simply waiting on the jobs number to figure out what to do next. If we can break above the highs of the Wednesday session, it would be an all-time high again, and would slice through a shooting star. That of course would be a very bullish sign and unleash a lot of buying pressure. At that point, it would be a simple continuation of the large trend.

On the other hand, if we were to break down from here the 50 day EMA sits at the 12,800 level. This is a market that continues to rise quite drastically due to the fact that liquidity is being flooded into the system, and a lot of Wall Street traders are throwing money at the same stocks that have continually lifted the NASDAQ 100. Another thing to keep in mind is that the jobs number is probably going to continue to be a major volatility event, so we could see a selloff. If we get that, then it is more than likely going to be an opportunity to start buying the NASDAQ again. After all, there is almost always some type of narrative that the jumps in on Wall Street to get people buying again. It is not until we break down below the 12,500 level that I would be concerned, and that is 1000 points from here.

The market more than likely it is going to go looking towards 14,000 next, and then eventually the 15,000 level for the longer term. I have no interest in shorting this market, and I think that it is only a matter of time before value hunters continue to come back due to the fact that the liquidity measures have trained Wall Street always buy the dip. I know that sounds a bit cynical but quite frankly it has worked for 13 years. The 50 day EMA continues to attract a lot of attention so it is difficult to think that we break down anytime soon. Because of this, I think that the exuberance will continue for the foreseeable future.