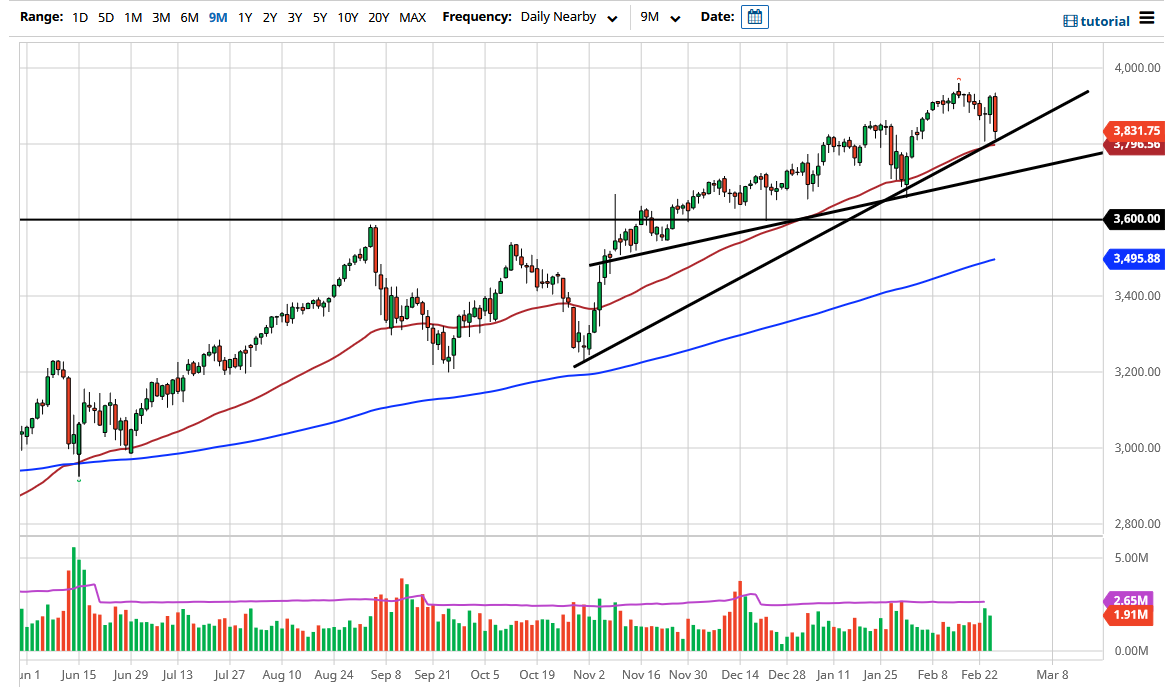

The S&P 500 has broken down significantly during the trading session on Thursday to crash into the uptrend line and of course the 50 day EMA. The 3800 level underneath is a large, round, psychologically significant figure as well, so at this point it is obvious that we have seen a certain amount of buying pressure at the end of the day. That being said though, it was a market that was reacting to higher interest rates, something that is somewhat toxic to risk appetite at times, because it is easier to simply hold on and collect interest instead of taking the risk of stocks.

This does not necessarily mean that the uptrend is over, just that algorithmic programs are stepping into the marketplace and readjusting portfolios based upon that. All this being said, we closed towards the bottom of the candlestick and this does typically suggest that we may see a little bit more negative pressure the next day. If we break down through the 3800 level, then you can see the uptrend line underneath that I have drawn, and I do believe that we will see buyers in this area.

The trend is still bullish, and we still technically have a target for the 4000 level, which is a large, round, psychologically significant figure, and is the measured move from the previous consolidation area that was between the 3200 level and the 3600 level. All things being equal, I think that this is a market that is trying to go higher but it is going to be very noisy in the short term. Quite frankly, this is a market that I do think given enough time will continue to go higher, so I am looking for value underneath.

If we do break down significantly, maybe I will start buying put options in the SPY, but I would not come in and short this market directly, because quite frankly that is a great way to lose a lot of money as the Fed has a habit of coming in and saving things when they get out of hand. This will be a very interesting session on Friday, as we start to head into the weekend and a lot of traders may want to protect themselves before the markets close. One thing is for sure, caution is the most important thing here.