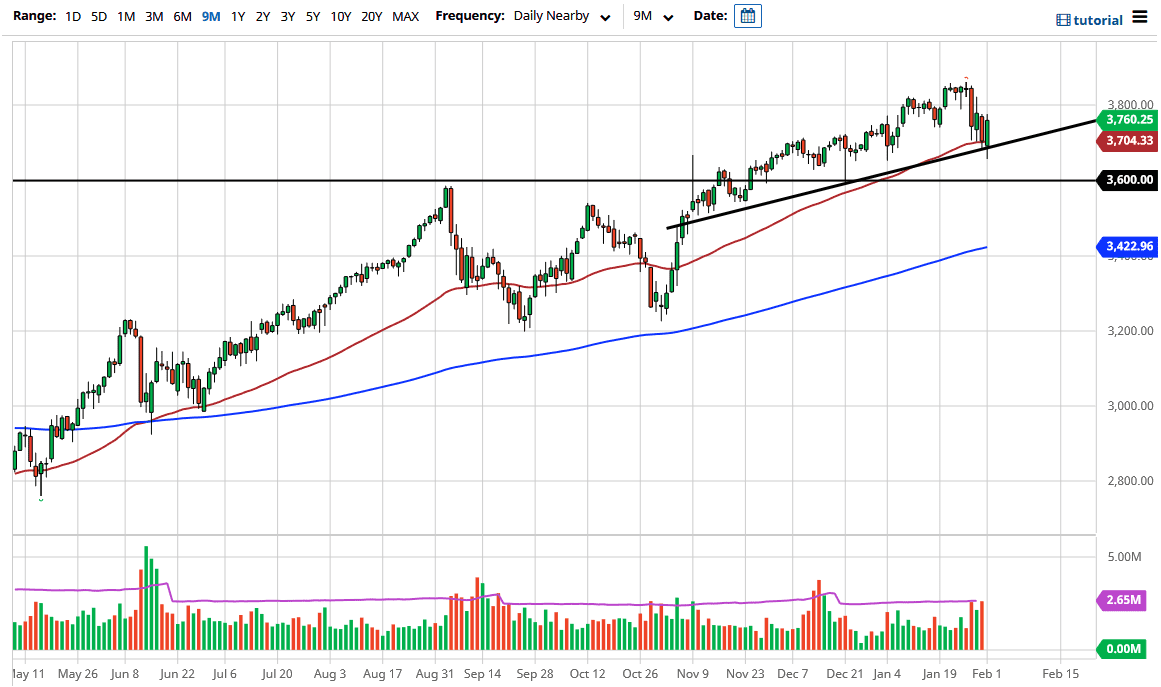

The S&P 500 initially dipped during the trading session on Monday but started to see buyers jump back into the market as we have held the uptrend line. The 50-day EMA also has held quite a bit of support as well. At this point, the market is likely to continue seeing buyers jump into this market when there is a dip, as we are in such a bullish trend. With the 50-day EMA holding as the uptrend line, it is likely that we will continue to see technical traders coming back into the market, reaching towards 3800 above.

Longer term, I believe that this market goes looking towards the 4000 level based upon the measured move of the previous consolidation. That consolidation had a support level at 3200, with a major resistance level at the 3600 level. Measuring that 400-point range on the breakout is how I get the 4000 target. The S&P 500 is also lifted due to the idea of stimulus and the general “risk on” type of situation that the market finds itself in as they bank on the idea of vaccinations opening up the economy again. Whether or not that actually happens is a completely different question, but that certainly seems to be the narrative on Wall Street at the moment.

There is no scenario right now in which I am interested in shorting the S&P 500, unless we were to get some type of truly shocking news like stimulus being canceled in the United States. I have a very hard time believing that is going to happen, so at this point, I think buying the dips will continue to be what we look at in general, as the gamblers on Wall Street continue to look for cheap and free money. I do not see any reason why things would change, but I recognize that if we were to somehow break down below the 3500 level, it could lead to a much bigger move to the downside. Even then, I suspect that we are looking at the possibility of buying value underneath. As the index is not made of equally weighted companies, I find it difficult to short this market in general.