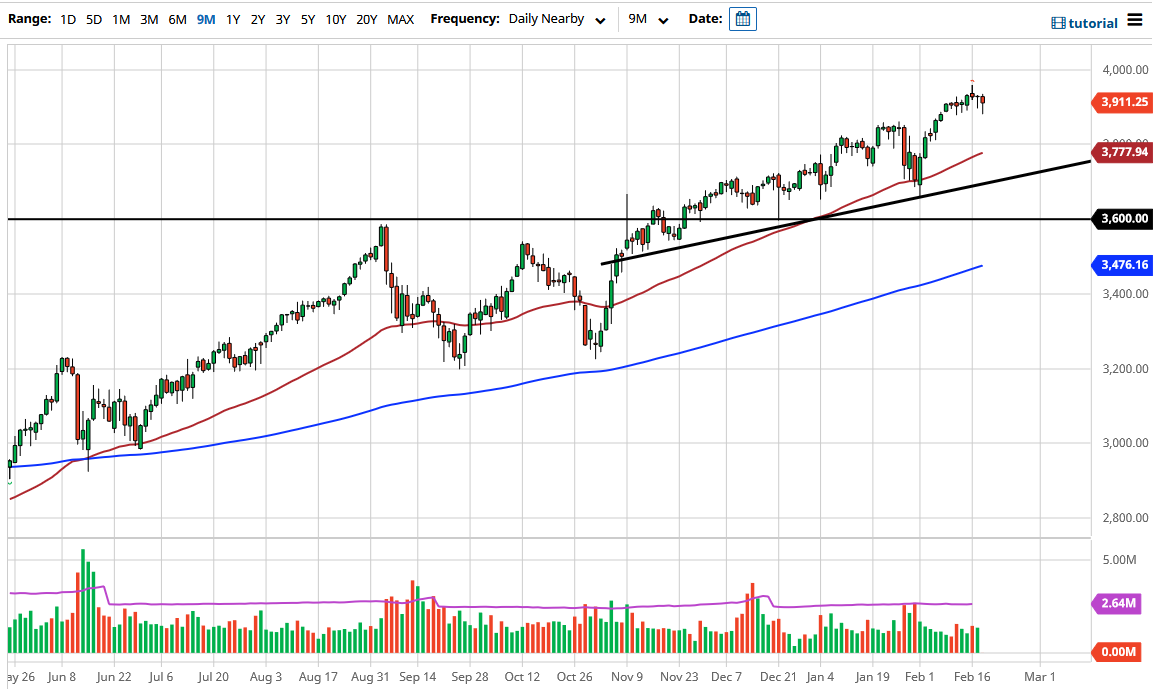

The S&P 500 has pulled back a bit during the course of the trading session on Thursday only to turn around and form a bit of a hammer. Ultimately, this is a market that I think is trying to give hints that the area near the 3900 level will continue to be defended, and therefore it should not be a huge surprise that we have tons of liquidity coming into the market on an almost daily basis, so therefore I think we will probably see buyers jumping into this market on pullbacks.

Looking at the chart, I think that we are still trying to get to the 4000 level, but this is a move where I think a lot of profit-taking will probably show up at that level as well as it is a large, round, psychologically significant figure. Furthermore, when you look at the previous consolidation it was 400 points high, reaching from 3200 to the 3600 levels. Now that we have broken out above the 3600 level, that measures for a move to the 4000 handle. Regardless, we are in an uptrend and you should always pay close attention to these big figures.

The handful of candlesticks that we have seen over the last week or so suggest that we are going to go back and forth and try to build up enough momentum to break out to the upside. If we pull back from here, I would like to see this market reached towards the 3850 level, which is a significant area of support and resistance on short-term charts, but I think it is much more interesting at the 3800 level underneath, which is where the 50 day EMA is sitting at and should attract a certain amount of attention by itself. The S&P 500 continues to move based upon the handful of companies that everybody loves, and of course has seen a lot of noise due to the 10 year yields breaking out recently. As bond yields rally, that has people rebalancing their portfolios, which of course has an effect on the stock market. At the end of the day though, we have turned around to show signs of further bullish pressure as per usual. Given enough time, it is likely that we need to test that 4000 level to see if we can continue to go higher.