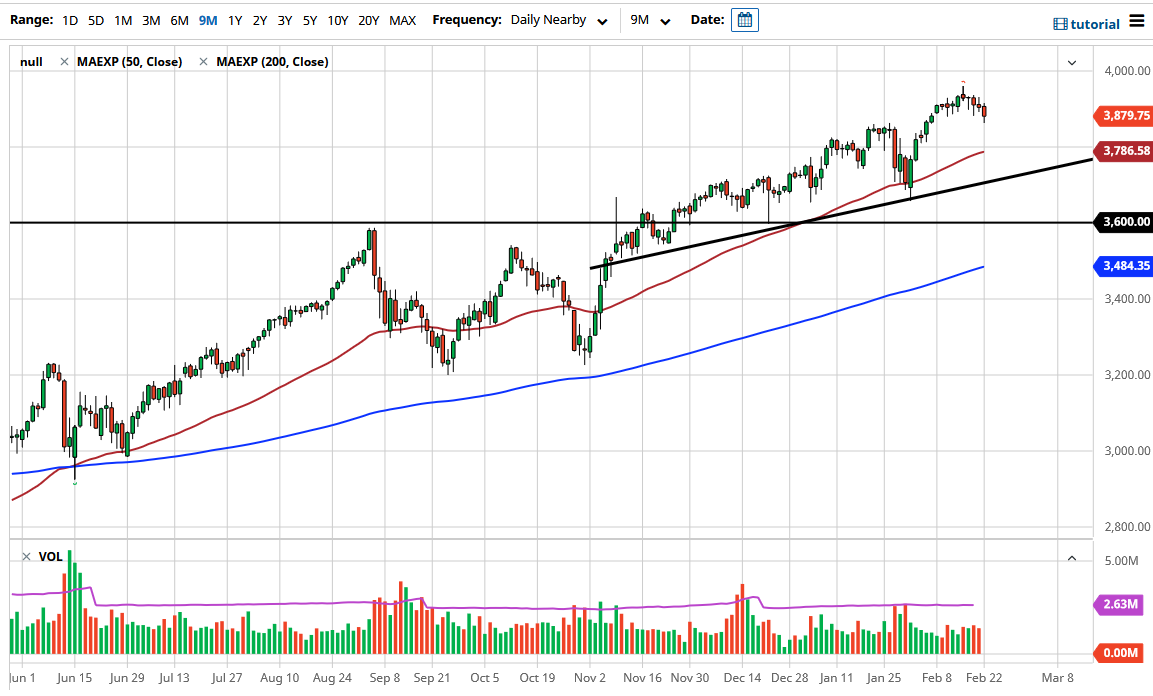

The S&P 500 pulled back a bit during the trading session on Monday to reach down towards the 3860 level. We also have the 50-day EMA reaching towards the 3800 level, an area that should cause a certain amount of attention due to the fact that it is a large, round, psychologically significant figure. The 50-day EMA is closely followed by technical traders, so it would not be surprising at all to see this market bounce from that area. Furthermore, even if we break down below there, we have a nice uptrend that comes into play as well, so I think what we have is a scenario where it is only a matter of time before buyers come in to pick up value.

The market has been bullish, so we need to find a bit of value that we can take advantage of. Given enough time, we will have buyers coming back in and pushing towards the psychologically tempting 4000 handle, which is also a target based upon the previous consolidation area that we had been in that extended from the 3200 level on the bottom and the 3600 level on the top.

I would be very cautious about jumping “all in” right away due to the fact that we have so much in the way of potential volatility, and the 10-year yields rising in general as of late. Because of this, it is likely that we will have to keep an eye on the market over there as well. After all, as yields rise, it causes a bit of forced rebalancing of portfolios, and one would have to think that sooner or later there will be concerns about rising yields. In the short term though, I think this will only offer an opportunity to pick up a little bit of value that you can take advantage of, and I would be cheering that on, at least for a short-term situation where you could pick up the S&P 500 “on the cheap.” I have no interest in shorting this market, as that has been a losing game for ages. If it does break down significantly, then you could be looking at buying puts more than anything else.