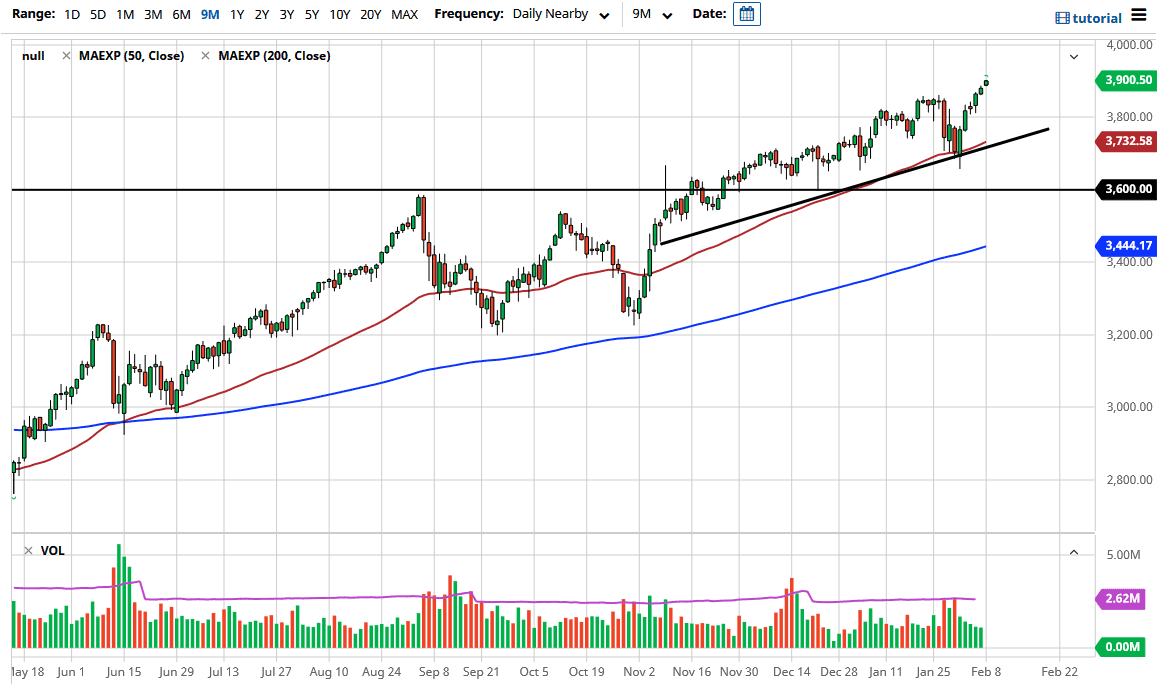

The S&P 500 continued to rally during the trading session on Monday, breaking towards the 3900 level. Now that we are here, the question is whether or not we can continue to go higher. Of course we can, because the market is driven by liquidity, and liquidity is the one thing that the market can count on. To the downside, the 3800 level is very likely to see a lot of support, as it is a large, round, psychologically significant figure. After that, there is significant support underneath at the 50-day EMA and the uptrend line. This is a market that I believe will eventually find plenty of buyers based upon liquidity and the fact that it is in an uptrend to begin with.

The market has been in an uptrend for quite some time, and I think that it is not until we break down below the uptrend line that you would even be concerned about this market. Even if we break down below there, it is likely that the market could go looking towards the 3600 level where we would see plenty of buyers. The 200-day EMA is reaching towards that area and, based upon the previous actions that we have seen, the market has tested the 3200 level as support, while the 3600 level has been resistance in the past. Now that we are broken out of that area, it extrapolates to a 400-point move. At that point, the market is likely to go looking towards the 4000 level.

This is a market that you simply buy on dips. That has been the way the market has behaved for the last 13 years, and even though we get the occasional massive sell-off, the reality is that there are plenty of people in the Federal Reserve that are willing to step in and protect Wall Street if it is going to suffer any type of losses. Coupled with Washington DC, it is likely that we will continue to see plenty of buyers or liquidity step in in order to protect large trading houses. It is not the way the game should be played, but it is the reality. Markets are to be bought when it comes to the index, due to the fact that it is only a handful of stocks that move the S&P 500.