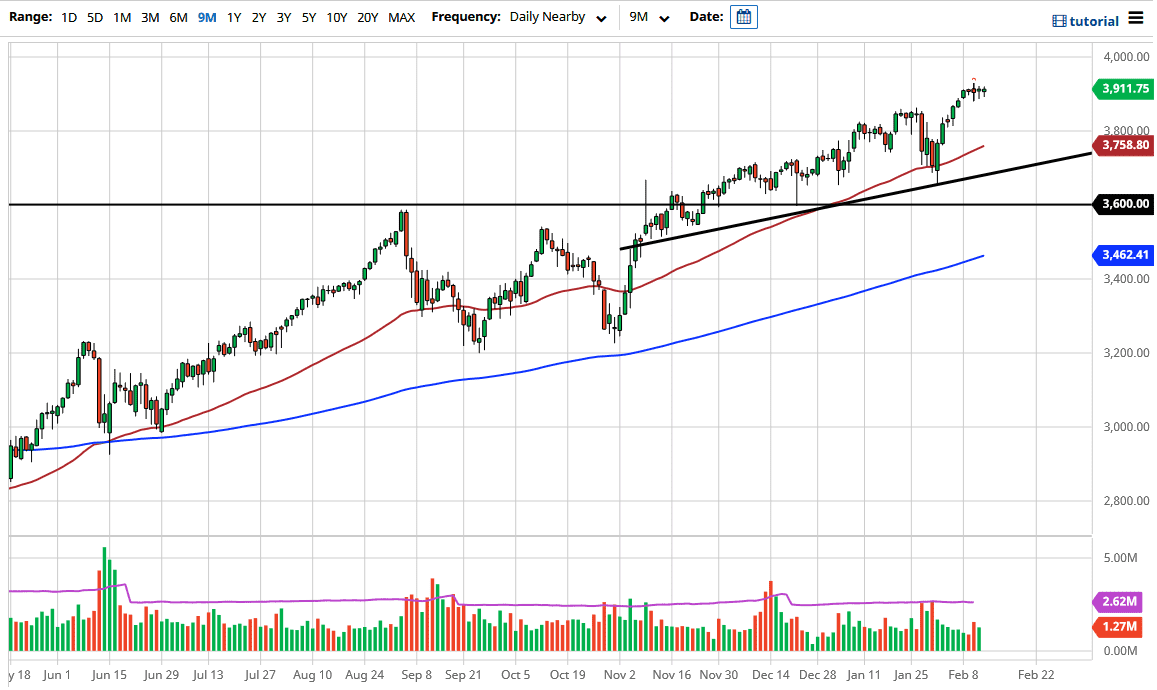

The S&P 500 fluctuated during the trading session on Friday as we continue to dance around just above the 3900 level. This is an area that attracts a certain amount of attention due to the fact that it is a large, round, psychologically significant figure, but it is also an area where we had seen a lot of options expiring this week. We are in the midst of earnings season, so that has a lot to do with volatility as well. When I look at this chart, I do think that it is only a matter of time before we go looking towards the 4000 level, as it is the next major area that people will be watching.

To the downside, I think there are more than enough reasons to think that there are plenty of support levels underneath that you should be paying attention to. The 3800 level is an area that I think is very interesting, as the 50-day EMA is now starting to race towards that area, so if we pull back to that region, I would anticipate some type of confluence that could have buyers jumping in. After that, we have the uptrend line that could come into play as well. What I am getting at is that if we pull back, it should be looked at as a potential value play due to the fact that the indices in America have been so strong.

When you get a massive shot higher, you have to think of the possibility of working off the froth. Currently, we are doing just that by going sideways. You either see a pullback, or a sideways market kill time in order to work off some of the excess. I think it is only a matter of time before we go higher, so I have no interest in shorting and I would love buying one of those pullbacks, assuming we even get one. If we break above the highs of the week, which is the Wednesday candlestick, then I think it is likely that we will go looking towards the 4000 handle. If we break above there, then it becomes the next leg higher, something that I do think we will get sooner or later due to all of the stimulus is being forced down the throat of the market.