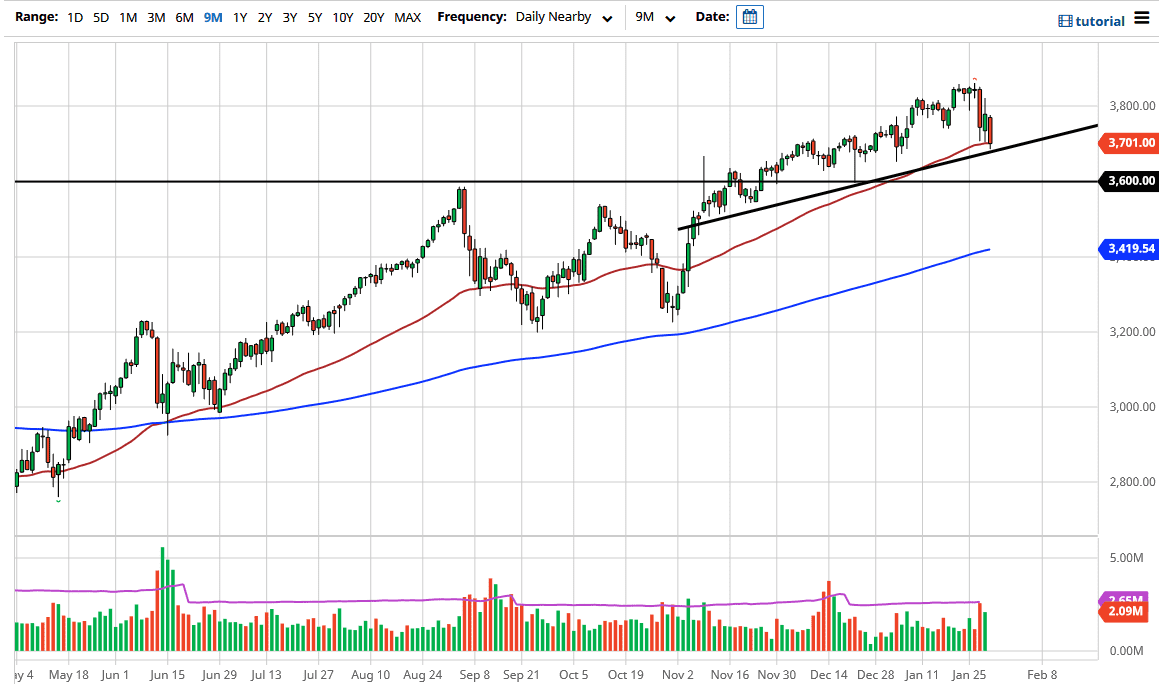

The S&P 500 fell a bit during the trading session to reach down towards the 50-day EMA. Furthermore, the uptrend line is just underneath, and I think that we could see buyers come back into this market based upon the fact that a lot of the freak out has been due to options shenanigans more than anything else. This is a market that still has plenty of things going for it, not the least of which is the reflation trade. In fact, it is all about reflation and stimulus as far as Wall Street is concerned, so eventually the sideshow will pass, and people will start to look towards the future.

Even if we were to break down below the trend line, the 3600 level underneath should offer support. A breakdown below there then could get the selling really moving, perhaps sending the market down to the 200-day EMA. That is not my base case scenario; just something that I am aware could happen.

On the other hand, the 3800 level above is an area that people will probably target if we bounce, and if we break above there, it is likely that the market will go looking towards the highs again. Eventually, we can break above the highs and go looking towards the 4000 level, which is my longer-term target anyway. After all, Wall Street always seems to find some type of narrative to push stocks higher, so it is probably only a matter of time before the bullish pressure takes over again. For what it is worth, we even started to see a little bit of pushback towards the end of the session, which suggests that perhaps people did not want to go into the weekend short.

In general, this is a market that is waiting for some positive news regarding the stimulus situation and perhaps even coronavirus vaccination numbers. They are getting better, and we are starting to look past it. It is also worth noting that the market did hold on to the 3700 level in the futures market, so that is something to hang your hat on. I certainly would not be a short seller at this point, so if we did break down and I wanted to try to profit off it, I would be a buyer of puts.