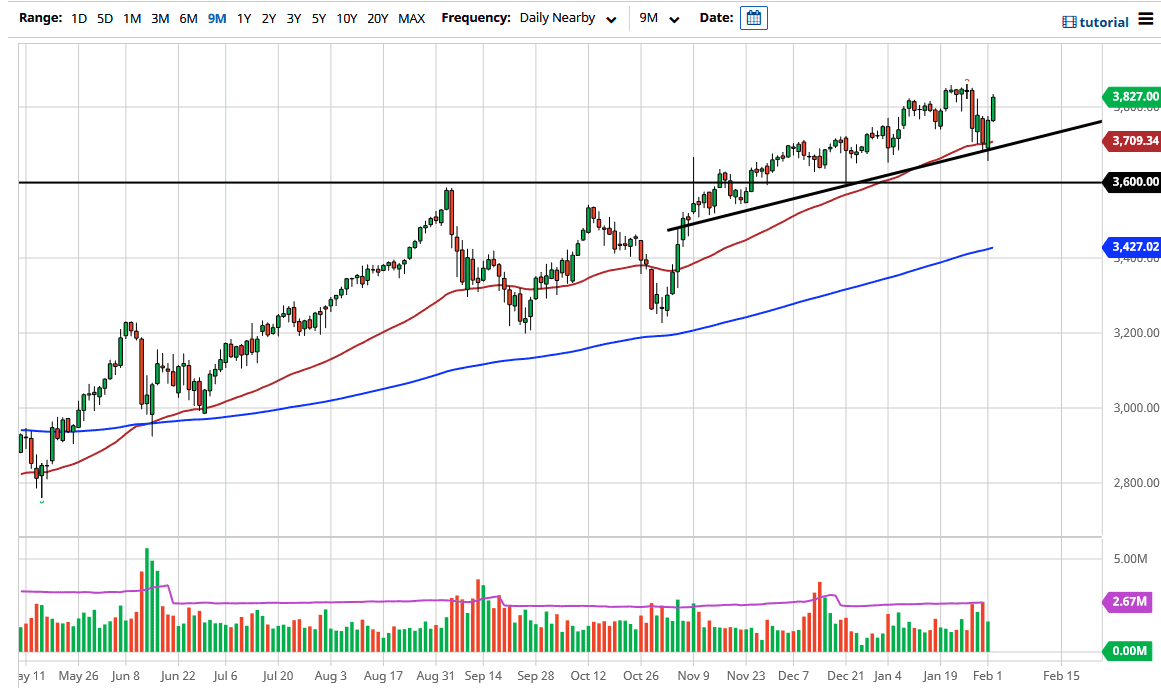

The S&P 500 rallied again during the trading session on Tuesday as it looks like we are trying to break above the recent highs of 3850. At this point, we are in the midst of earnings season, and we will get a certain amount of volatility, but stocks only rise over the longer term. With that in mind, I simply look at the 50-day EMA and the uptrend line underneath showing signs of support as a trading signal. If we pull back from here, it is likely that we would see buyers jumping in based upon “value”, due to the fact that every time we pull back there are plenty of people trying to get in on the momentum.

In fact, even if we break down below the 50-day EMA and the uptrend line, it is likely that we will find plenty of buyers near the 3600 level next. That is an area that has been tested a couple of times in the past and was the previous breakout point. Actually, when you look at the consolidation underneath, we have bounced from the 3200 level to break out above the 3600 level. That extrapolates for a 400-point move on the breakout, meaning that we should then go to the 4000 level. I do think that we will get there given enough time, and short-term pullbacks give an opportunity for people to get involved and build up a larger move.

We will have a lot of noise, but as long as the Federal Reserve floods the markets with liquidity, everybody on Wall Street will be excited and happy. They will continue to buy stocks because that is what they do, trading cash for assets that appreciate over the longer term. It is a matter of wealth preservation, and as long as the “S&P 500 7” continue to rise, being the same stocks that everybody else’s buying, the S&P 500 will continue to go higher over the longer term. If we get a massive crash, the big money will be down at the bottom willing to pick it up again.