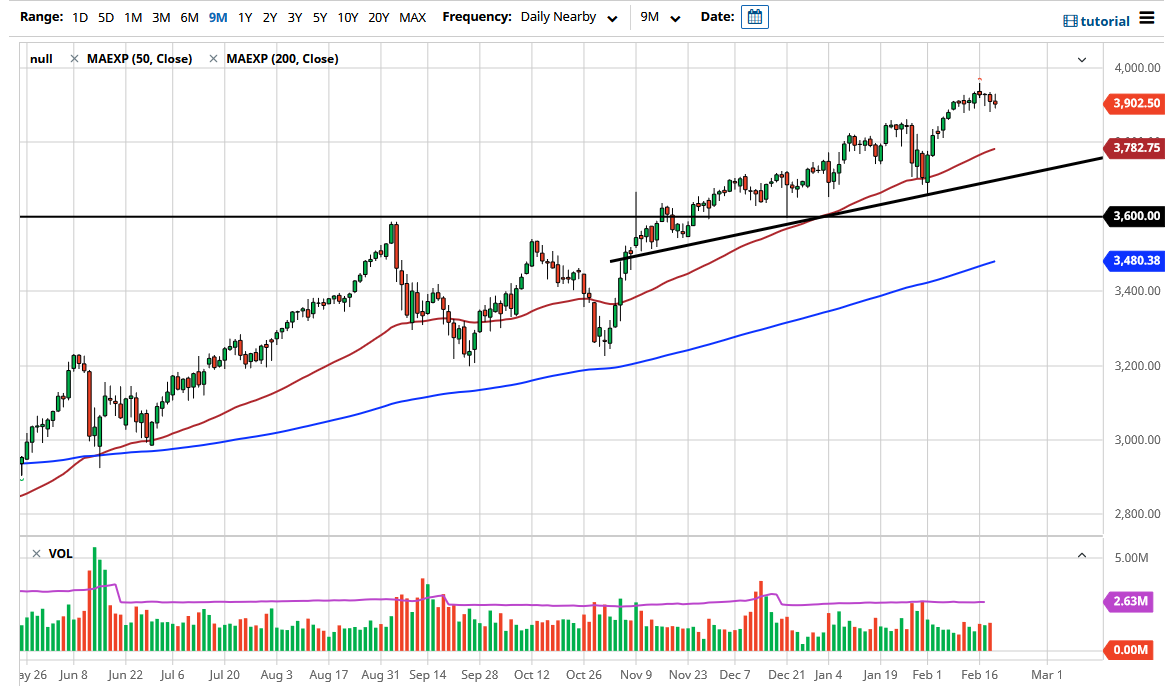

The S&P 500 initially tried to rally during the trading session on Friday but then gave back the gains to form a shooting star-shaped candlestick. This suggests that perhaps we have a bit more downward pressure coming, but at the end of the day I think that we are looking at a market that is still very bullish based upon liquidity measures. As money gets thrown around the market and financial system, traders continue to buy equities because of low bond yields. Having said that, low bond yields might be less of a factor these days, due to the fact that the 10-year note is seeing yields rise as of late, and on Friday cracked above the 1.34% handle.

When you see interest rates rally like that, people will have to rebalance their portfolios quite often, and that can drive stock markets down a bit. This is a market that has been very noisy over the last couple of days, and I think we are either going to kill time and work off the froth, or perhaps pull back a bit in order to try to find value underneath. I believe that if we pull back from here, we could see buyers at 3850, and then the 3800 level, which has a large, psychologically significant aspect to it as well. The 50-day EMA is sitting just below there, so that means that technical traders will also look at that as an area that could cause a certain amount of support as well.

I do not have any interest whatsoever in trying to try to short this market, because it is a market that has shown a proclivity to go higher under all circumstances and pullbacks have been bought into aggressively. If we do break down a bit, I think what we would be looking at is a scenario in which you could buy put options, but shorting is all but impossible. My longer-term target remains 4000, but I think a pullback makes sense as we could just continue the overall angle of attack to the market, and not try to overheat too much.