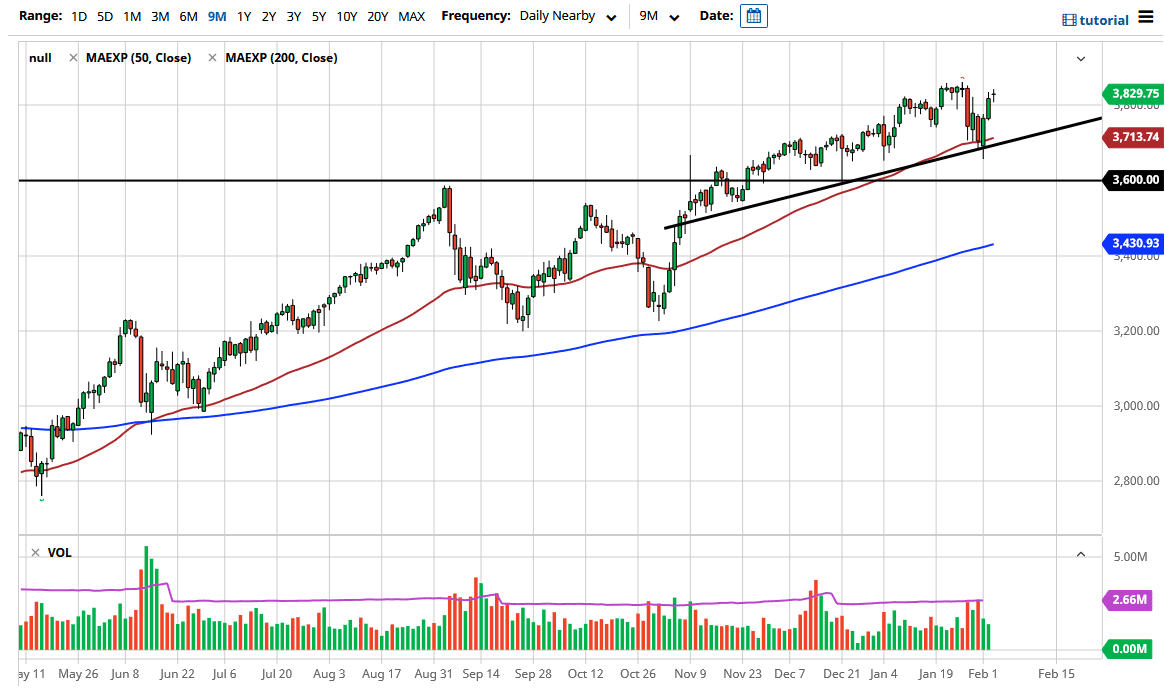

The S&P 500 has gone higher during the trading session on Wednesday but gave back the gains as we continue to fluctuate. When you look at the candlestick, it shows that we are running out of momentum, which should not be a huge surprise considering that the last couple of days have been so explosive to the upside. Looking at the chart, it is obvious that we are in an uptrend, and the fact that we bounced from the 50-day EMA is impressive. Beyond that, the uptrend line has offered quite a bit of support as well, so I think that what we are starting to see is a lot of back and forth with a general upward tilt.

To the upside, if we can break above the 3860 handle, it is likely that we will see the market reaching towards the 3900 level, possibly even the 4000 level. The 4000 level has been my target for some time, and I do think that eventually we will get there. This means that we will probably have a lot of fluctuation on the way up, as long as we can stay above that uptrend line. Even if we break below the uptrend line, then I believe that the 3600 will offer support as well. I do not have any interest in shorting this market, because everybody knows that the S&P 500 is really just seven stocks pushing it more than anything else. We have plenty of liquidity out there to continue to push money into the same handful of stocks, and we have the “groupthink” on Wall Street that continues to throw money in the same companies. The market is likely to continue to see a “buy on the dips” scenario, as there continue to be massive amounts of liquidity thrown out there that Wall Street is trying to absorb by purchasing assets such as stocks. In general, I have no interest in shorting this market, and I believe that no matter what happens next, we will eventually find our way towards the 4000 level. Dips continue to present value from a longer-term standpoint, and therefore we will continue to see more of the same behavior.