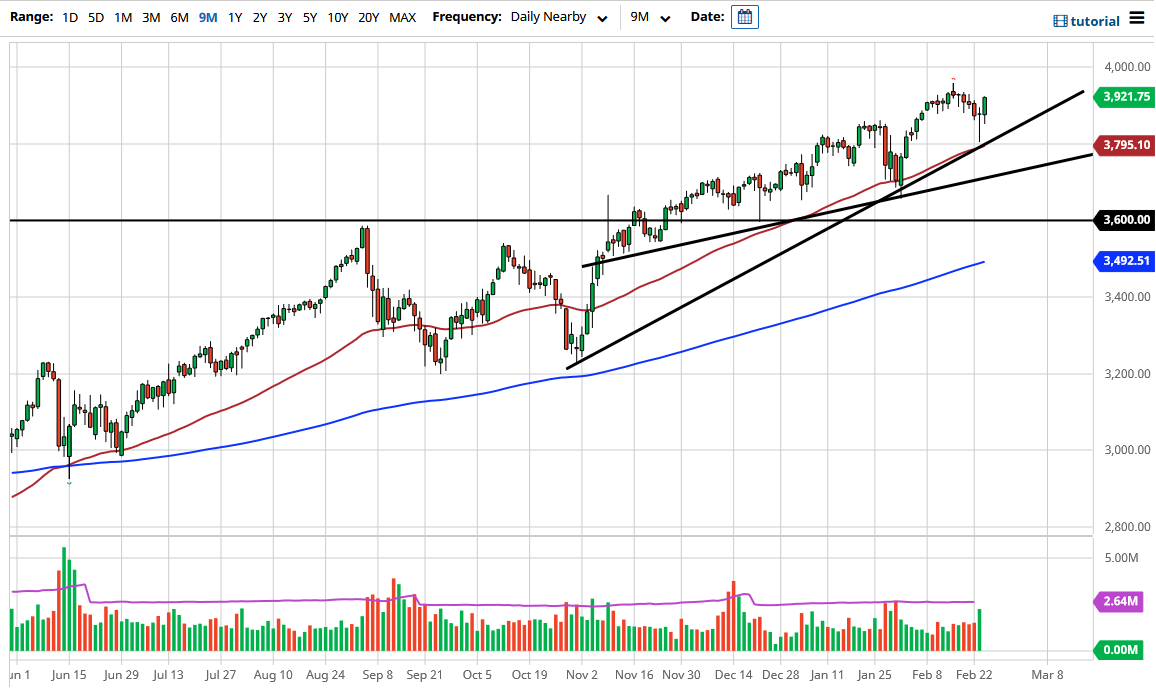

The S&P 500 initially pulled back a bit during the trading session on Wednesday as yields in the 10-year note spiked. However, we have seen them fall back below the 1.40 level again, and therefore the market calmed down, sending stocks much higher. We broke above the top of the hammer during the previous session, and that is a very bullish sign, suggesting that we are going to go looking towards the highs again. The Federal Reserve has stated over the last 24 hours multiple times that they were going to continue to “cushion the blow” for Wall Street, meaning that cheap and easy money is going to continue to flow toward them.

The hammer from the previous session is a very bullish sign, as it has bounced from the 50-day EMA, an indicator that a lot of people will pay close attention to. Furthermore, there is also the 3800 level at the bottom of the candlestick, and we have the uptrend line coming into play in the same region. Shorting the S&P 500 is a great way to lose money, and it should not be a huge surprise that we have continued to see buyers on dips.

Based upon the previous consolidation between 3200 on the bottom and 3600 on the top of that range, the measured move was 400 points, so if we can break above the 3600 level it could open up the move to the 4000 handle, which is my longer-term target. We have gotten there much quicker than I thought, so the 4000 level is where people will probably be looking to take profit, and I think that 4000 will probably cause a certain amount of noise.

The market breaking down below the uptrend line would be negative, perhaps opening up the door to the previous support level. I have no interest whatsoever in trying to short this market, because it is a great way to lose money as there are plenty of reasons and narratives on Wall Street to think that the S&P 500 will go higher. The only way that I express a negative opinion on this market is to buy puts in the SPY, because at least then I can keep my risk somewhat limited. Nonetheless, this certainly looks like it is going to continue to be a “buy on the dips” scenario.