The US dollar initially pulled back a bit against the Canadian dollar during trading on Tuesday but then turned around to bounce rather significantly. The way it has bounced suggests that we do have a fight on our hands, and there are a couple of different things going on in this market that may be paid attention to in order to get a little bit of a “heads up” when it comes to where we are going next.

The first problem was the 10-year note during trading on Tuesday as the interest rate started plowing higher. The 10-year note broke above the 1.25% level, meaning that money flew into the greenback overall. As the greenback rises, you have downward pressure on crude oil markets. Remember, the Canadian dollar is highly levered to crude oil, so the fact that oil has run into major resistance and pulled back certainly would work against the value of the Canadian dollar, just as we have seen during the day. The 1.26 level underneath is major support based upon longer-term charts, and at this point it is very likely that the correlation will continue.

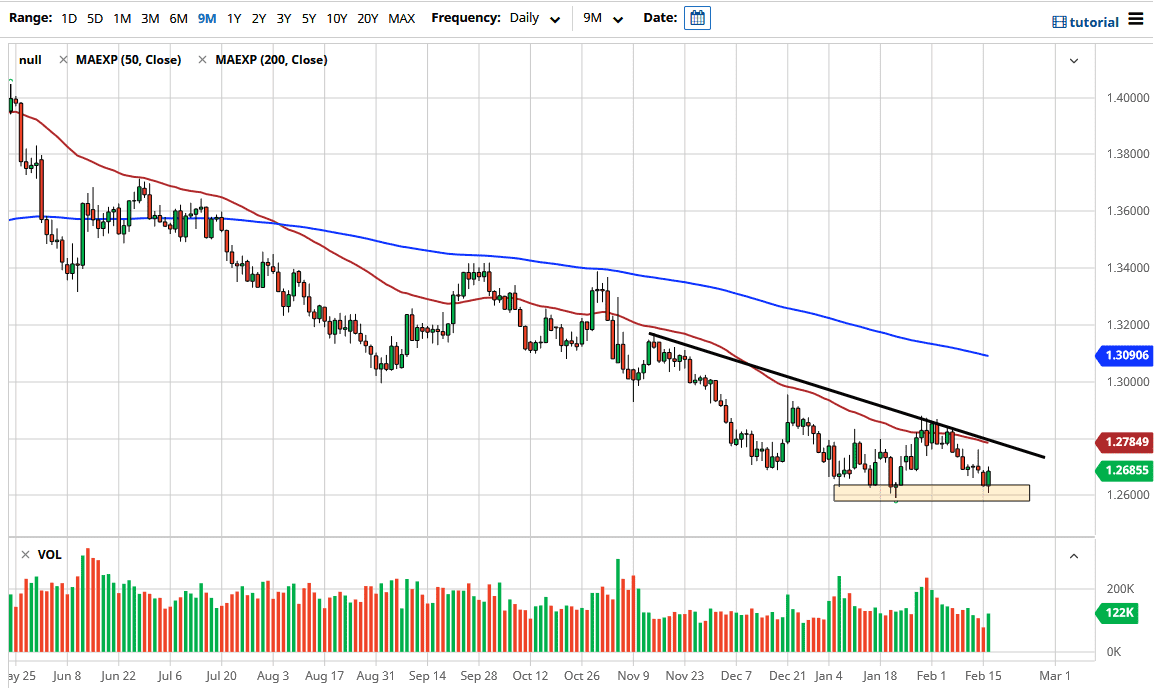

To the upside, the 50-day EMA is at the 1.2784 level, sitting just below the longer-term downtrend line that I have marked on the chart. We have filled a small gap from a couple of days ago as well, so that might be worth paying attention to also. In general, this is a market that is trying to determine whether or not the longer-term support level would hold for a bigger move to the upside. The 1.25 level on the monthly chart is crucial, so we are getting close to making some type of longer-term crucial decision. If we were to break down below the 1.25 handle, then it is likely that the dollar could go much lower. On the other hand, if we can hold some type of stabilization, perhaps on a weekly candlestick, then we could see a massive reversal. This is definitely an area that we need to be paying close attention to, but right now it still favors selling short-term rallies as we are still showing signs of US dollar weakness from the longer term. Having said that, the US dollar, and by extension, the US Dollar Index are at major support levels, so expect volatility.