The US dollar fluctuated against the Canadian dollar during the trading session on Wednesday, which in and of itself would probably not be noteworthy except for the fact that the crude oil markets broke out. That typically would have this pair dropping, as the Canadian dollar is a proxy for crude oil. We did lose a little bit of bullish pressure, but not enough to make a huge dent in what has been accomplished from the side of the greenback of the last couple of weeks. While not necessarily a signal, it is something worth noting.

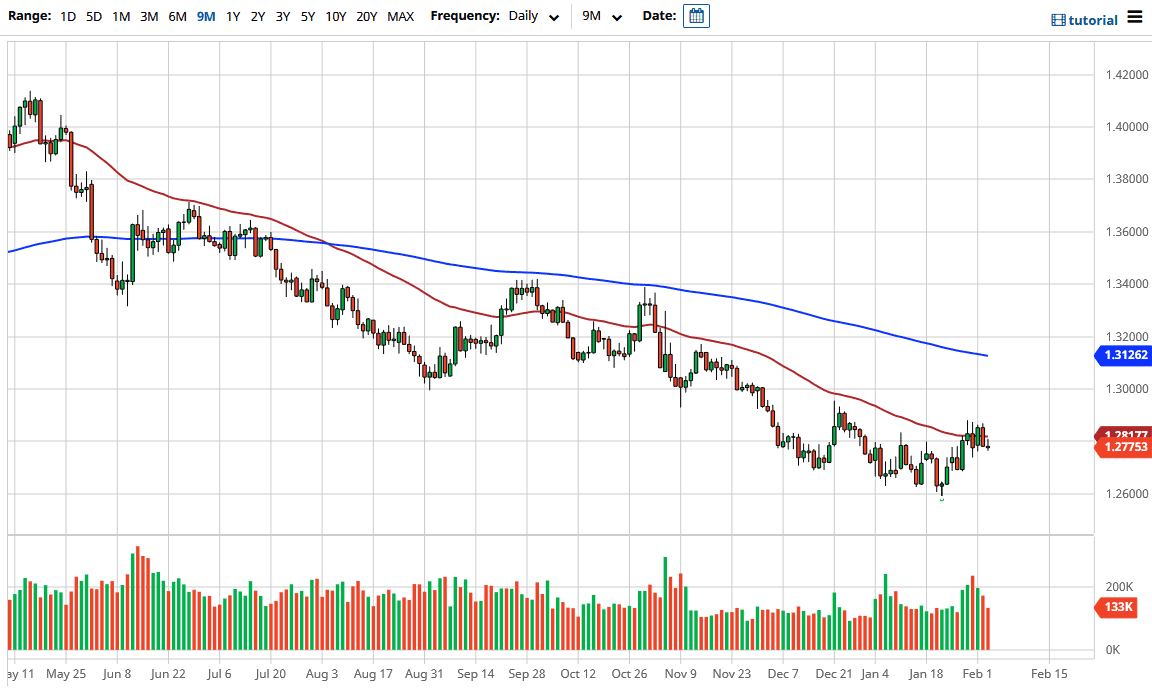

The market currently sits at the 50-day EMA, which it has straddled over the course of the last several sessions. It is very possible that there is some confusion right now, and people are debating whether or not the trend will continue, or if the US dollar is completely oversold. It is worth noting that the US Dollar Index also has reached down to extreme lows and bounced, which will have a “knock on effect” over here.

The Canadian economy has been struggling and is highly dependent on the United States. Because of this, you may see both of these currencies do better if the economic numbers out of the US continue to pick up, and at that point you would want to buy the Canadian dollar against other currencies around the world that are struggling. You do not necessarily want to buy the Canadian dollar against the greenback in that scenario. Furthermore, we are getting rather close to significant support, on the monthly chart no less. I do think that the 1.25 and the 1.26 level make up a huge “zone of support, so it is difficult to be a seller at this juncture. This is not to say that we cannot break down, just that there is a certain amount of historical precedents for buyers to step in and pick this market up in the same general vicinity. If we break above the 1.2850 level, that could open up a move towards 1.30 level. That is an area that probably offers even more resistance, but it looks like we are in the very early stages of an attempt at a trend change.