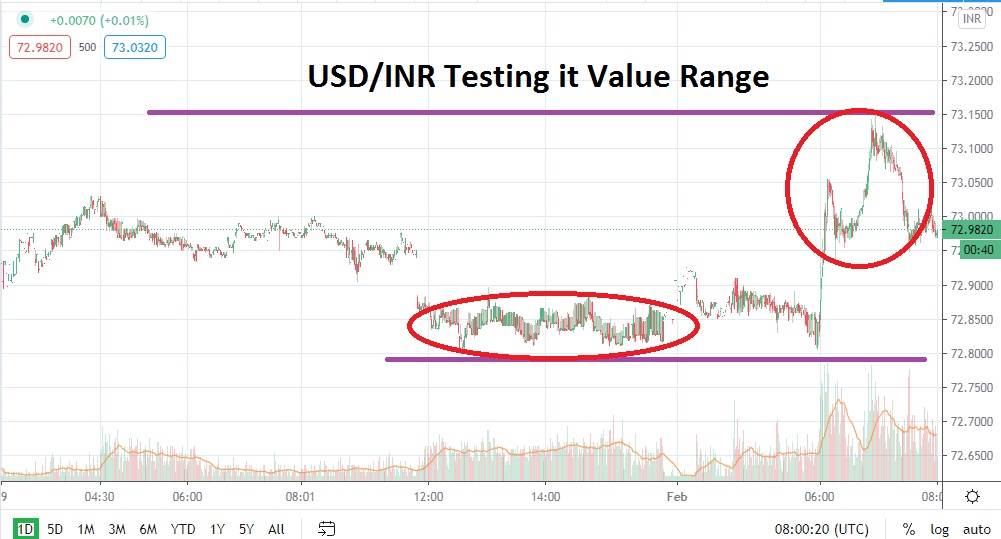

The USD/INR opened this morning with a swift movement downward testing the lower realm of its nearby support within the 72.800 level, but then promptly produced a strong spike higher and touched the 73.150 resistance mark. Hopefully, traders who were holding positions were using limit orders and were protected from the early storm.

The USD/INR is certainly exploring its new value range, and this may entice speculators because resistance proved durable during the volatile trading. Taking into consideration the early ‘hold’ by resistance near the 73.150 juncture and the ability of the USD/INR to then produce a reversal lower and now trade again below the 73.000 mark may be a key signal. The early move higher may have been a reaction to new support being tested below, which then sparked some programmed buying by financial institutions.

If this proves to be the case, then speculators should be intrigued and be looking at support levels as attractive targets to pursue. If the current support junctures of 72.920 to 72.840 prove vulnerable, it is possible that the USD/INR may be testing lower values sooner than later. From a technical perspective, it is possible that early action this morning near the 72.800 has already ignited many of the programmed buying positions and, if selling builds, support may be brushed aside more easily the next time around.

The USD/INR has provided a solid bearish trend, and while its price action often does produce volatility, the recent downward momentum and technical charts suggest that another move lower may be possible. Selling the USD/INR may feel speculative within its current price range because it is, but risk-taking can be fundamentally sound if proper limit orders are used to guard against volatility.

Remaining a seller of the USD/INR appears to be a logical decision. If the Forex pair sustains its price below the 73.000 juncture, it will be a solid sign for traders who are considering short positions. The ability for resistance to prove durable early this morning also may give impetus to speculators considering additional bearish pursuits. Traders need to monitor the USD/INR carefully, because it seems to be indicating that a potentially swift move is going to develop, particularly if current support levels do not hold.

Indian Rupee Short-Term Outlook:

- Current Resistance: 73.150

- Current Support: 72.890

- High Target: 73.320

- Low Target: 72.650