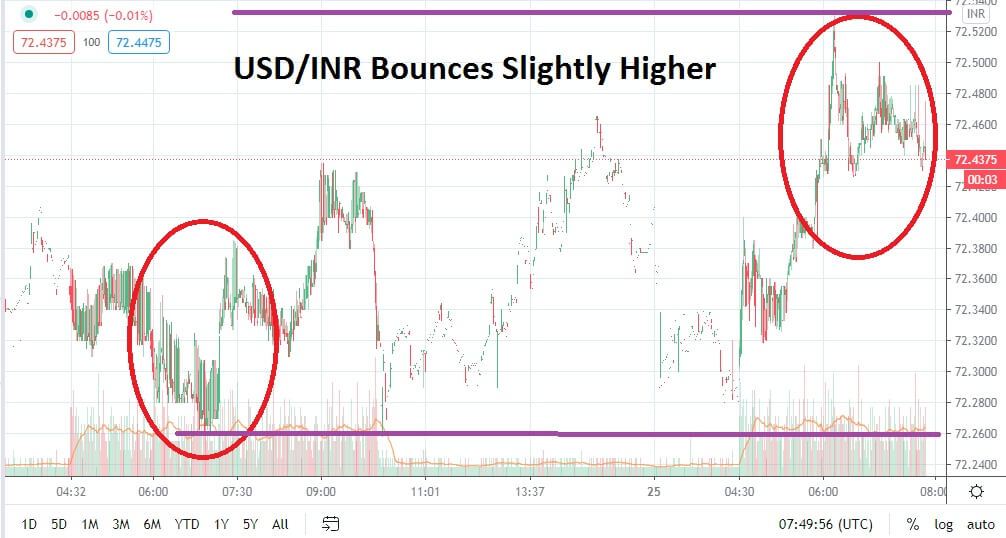

The USD/INR has seen a slight bounce higher in trading today after targeting lower values yesterday. The 72.250 support ratio was tested twice on Wednesday and produced reversals upwards on both occasions. Interestingly, after testing crucial long- term support marks the second time yesterday, the move upwards was not as aggressive.

In early trading this morning, when volumes increased, the USD/INR again proved it had an ability to track downward, but support near the 72.270 mark produced another reversal upwards. As of this writing, the Forex pair is near the 72.430 juncture, and this offers speculators an opportunity to consider their next moves while keeping in mind that the bearish trend of the USD/INR remains rather attractive.

Resistance should be watched carefully; a high which traversed above the 72.500 juncture was attained early today, but the trading within this upper realm failed to sustain. Trading volumes have been steady as reported via technical data, and the USD/INR seems to be fighting for direction as it gyrates within its current value band. Intriguingly perhaps to experienced USD/INR traders, is the notion that the Forex pair has not produced violent surges as it sometimes is known to do.

The lack of intense volatility and the rather steady bearish momentum the USD/INR has demonstrated consistently since late in the third week of December is noteworthy. Resistance levels may prove important in the short term for conservative traders who wish to pursue bearish sentiment. The juncture of 72.550 to 72.590 will be crucial for speculators. If this price ratio proves durable and is not broken higher near term it could be an indicator that the USD/INR may be ready to stage more downward action.

Selling the USD/INR on slight moves higher which come within the current resistance levels of 72.460 to 72.500 should be considered by traders who perceive that further technical bearish momentum will be exhibited. Short-term traders need to be alert within the USD/INR because it has enjoyed a substantial selling posture, and yesterday’s bounce higher after testing vital long-term support may produce more temporary gyrations. However, if proper stop loss ratios are used, speculating on bearish price action may be the appropriate trading choice when resistance levels are challenged by activating selling positions via limit orders.

Indian Rupee Short-Term Outlook:

Current Resistance: 72.500

Current Support: 72.380

High Target: 73.590

Low Target: 72.240