For two weeks in a row, the USD/JPY has tried to correct the upside. The rebound's gains were capped by testing the 105.76 resistance level, the pair's highest in nearly three months, before closing the week’s trading around 105.38. The bounce gains stopped in reaction to the results of US jobs data for the month.

Employment in the US saw a modest increase in January, according to a report issued by the Labor Department. The report said that non-farm payrolls increased by 49,000 in January after falling by 227,000 revised jobs in December. Economists had expected employment to rise by about 50,000 jobs compared to a loss of 140,000 jobs originally reported for the previous month.

The rise in employment in January reflected marked job gains in professional and business services, and in both public and private education. However, the growth was largely offset by job losses in the areas of entertainment, hospitality, retail, healthcare, transportation and warehousing. The Labor Department has also indicated that the seasonally adjusted increase in education jobs likely came at a time when pandemic-related employment decline in 2020 distorted normal seasonal accumulation patterns and layoffs.

On the other hand, the report also showed that the US unemployment rate fell to 6.3% in January from 6.7% in December. The unemployment rate was expected to remain unchanged. The unexpected decline in the unemployment rate came with an increase in domestic workers by 381,000, compared to a decrease of 206,000 in the size of the workforce.

Despite the decline in the numbers, Andrew Hunter, chief US economist at Capital Economics, said the relatively high unemployment rate "indicates that there is still some way to go in the labor market recovery." Hunter added, "However, since the introduction of the vaccine allows the economy to reopen and demand is given an additional boost of continued financial support, we expect the unemployment rate to reach 4.5% by the end of this year."

The report also added that average employee hourly earnings rose $0.06 to $29.96 in January. The annual wage growth was unchanged from an upwardly revised 5.4%.

A report issued by the US Department of Commerce showed that the US trade deficit narrowed in December, as the value of exports jumped by more than the value of imports. The ministry said the trade deficit narrowed to $66.6 billion in December from $69.0 billion in November. Economists had expected the trade deficit to narrow to $65.7 billion from $68.1 billion originally in the previous month.

The narrow deficit came as the value of exports increased by 3.4% to $190.0 billion, while the value of imports increased by 1.5% to $256.6 billion. The sharp rise in the value of exports reflects large increases in exports of crude oil, soybeans, capital goods, and auto vehicles and parts. Meanwhile, the marked increases in imports of supplies, industrial materials and passenger cars were partly offset by a decline in imports of consumer goods.

Commenting on these findings, Andrew Hunter said: “Exports were boosted by another increase in soybean shipments, most likely to China, with the value of industrial supply trade boosting in both directions through a recovery in energy prices.” The report also stated that the goods deficit narrowed to $84.2 billion in December from $87.0 billion in November, while the services surplus declined to $17.5 billion from $18.0 billion.

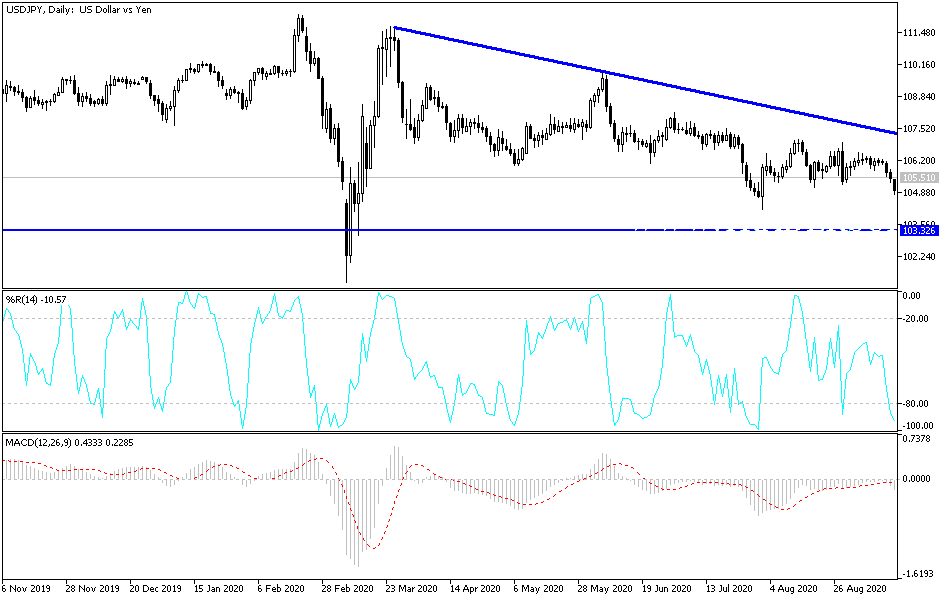

Technical analysis of the pair:

On the daily chart, the USD/JPY is moving within an ascending channel, close to testing the 106.00 resistance level, which may increase the bullish performance. On the downside, the outlook will not be bearish without breaching the support level at 104.00. It must be taken into account that if the currency pair moves towards the 106.00 resistance, it will push the technical indicators into strong overbought areas, and therefore, if it does not get momentum, profit-taking sales may ensue.

Amid the absence of the economic calendar of US economic data, the currency pair will be affected by the extent of investor risk appetite, as well as the announcement of the rate of bank loans, current accounts and the Economic Situation Watchers Index, which are all Japanese data.