Risk appetite in global markets has weakened the Japanese yen as a safe haven currency. This contributed to the USD/JPY's rebound higher to the 106.10 resistance level again before stabilizing around 105.85 as of this writing. The pair's price jumped after sell-offs for five consecutive trading sessions, which pushed it towards the support level of 104.92. A robust batch of US housing market statistics helped spark a sell-off in stocks and a surge in the value of the US dollar, as investors watched bond yields soar.

January new US home sales came in at 4.3%, against expectations of only 1.7% and well above the previous reading of 1.6%. Therefore, it appears that the market is in a positive state that may wipe out the bad news stage, an unexpected scenario rooted in the belief that the Fed will have to remove supportive stimulus measures if the US economy recovers strongly. As such, stock indices fell deeper into the red, and the dollar rose in the wake of the data's results.

The data and market reaction come at a difficult moment for investors who have struggled in the face of rising bond yields, which is also an indication of investors' expectations for a better economy and higher inflation levels in the future. The yield paid on US Treasury bonds with a maturity of ten years has risen sharply in recent days, indicating that investors are demanding more compensation in exchange for keeping these long-term assets in the expectation of higher inflation in the future.

Since the start of 2021, momentum has picked up and the yield has been broken close to 1.4%.

Therefore, the rise in bond yields and falling markets are the result of the market expecting higher inflation rates in the future, which is a natural reaction to the observation that the US government will spend huge sums in the coming weeks and months. Investors expect economic activity to recover strongly in 2021 as vaccines allow the United States and the global economy to return to normal, but inflation expectations are increasing in the United States due to the high budget deficit used to finance President Joe Biden's stimulus plans.

"The latest move is increasingly being seen as driven by legitimate inflation concerns in the wake of the US stimulus package that will push the US economy beyond its potential," says Yves Bonzon, Chief Investment Officer at Julius Baer.

Add to that the generous money supply created through the US Federal Reserve, and you can begin to understand why inflation is expected to return. Accordingly, analysts believe that the US economy will witness its strongest growth in more than 30 years, and the primary effect will help raise inflation to more than 2% during 2021. However, it will allow the inflation set by the bank to exceed its revised target of 2% over the course of the cycle. At the same time, higher bond yields are affecting investor behavior, with some being encouraged to exit equity bets and reinvest in fixed income (bonds), given the increased returns on supply, along with the traditional security situation.

The technology sector in the US has proven to be particularly sensitive to rising returns, as the NASDAQ fell 1.64% last week and down another 2.80% this week.

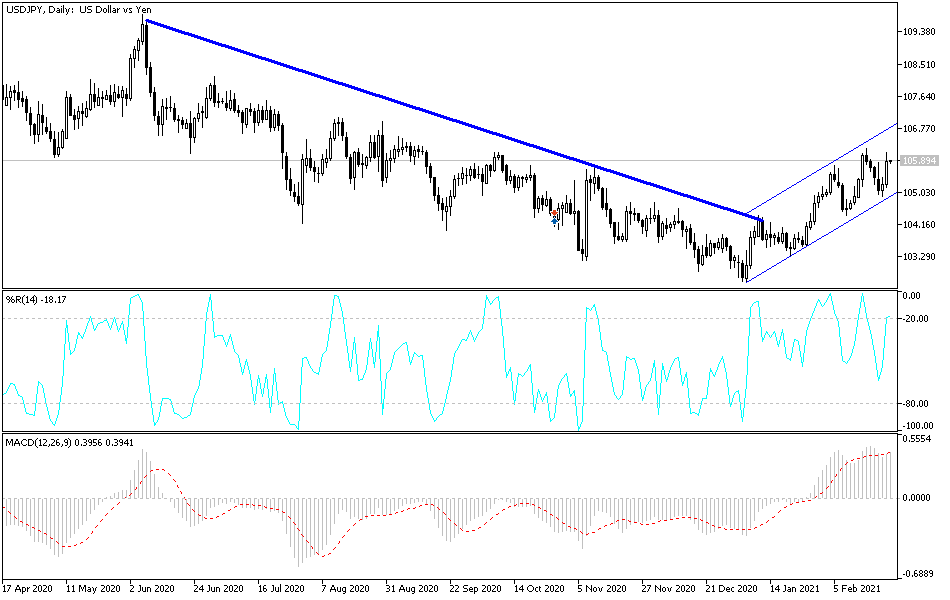

Technical analysis of the pair:

On the daily chart, the stability of the USD/JPY above the 106.00 resistance level will support a bullish performance and foretell a stronger upward movement to the closest resistance levels at 106.45, 107.20 and 108.00. In this direction, the psychological resistance of 110.00 will remain the most important target for the bulls in the medium and long term. On the downside, if the attempt to rebound to the current upside fails, a head and shoulders formation may appear over the same period of time, which supports the resumption of sell-offs again. The closest support levels then are 105.10, 104.75 and 103.90. Still, I would prefer to buy the pair on every downside.

Today's economic calendar:

All focus will be on US economic data, the most important of which will be the US economic growth rate, durable goods orders, US jobless claims for the week, and pending US home sales.