The USD/JPY is moving in an upward correction path this week that has tested the 105.17 resistance level, its highest in over two months, before stabilizing around 105.95. The dollar will remain in a state of anticipation for the announcement of US jobs numbers the ADP reading to measure the change in non-farm employment amid expectations of a slight improvement after the collapse in the last reading for the end of 2020. In general, the US restrictions to contain record cases of US infections and deaths from the coronavirus are putting strong pressure on the US labor market, which requires accelerating the pace of US stimulus plans. The new US administration under the leadership of Joe Biden is negotiating with the Republicans over the amount of that plan.

After having experienced a slight close this winter, expectations are that the US economy will recover strongly from the second quarter onwards. The expectation of several rounds of economic stimulus (the $1.0-1.5 trillion support package in late February) raises questions about the Fed and the dollar. As long as the Fed does not touch the short end of the curve, we suspect the dollar will remain under pressure. This is because the steeper yield curve allows US bond holders to operate high hedging rates in the foreign exchange market.

The markets are watching and waiting for the Bank of Japan meeting on March 18-19. Expectations are mounting that it may allow more flexibility in the 10-year Japanese government bond yield target and ease ETF buying, which may be positive for the Japanese yen.

Expectations at the beginning of 2021 indicate the possibility of a strong decline in the dollar and that it will be exposed to more challenges this quarter. Coronavirus spikes, asymmetric vaccine deployments and asset markets indicate a period of volatility rather than a benign spike in risky assets. However, as long as the reopening of economies remains on track from the second quarter, the volatility should give way to a resumption of the dollar's downtrend later this year. After falling 14% from its highest level in March of last year, the US Dollar Index (DXY) recorded a 2% rebound in January. The drive for this modest correction so far has been a combination of higher US Treasury yields and a recent slowdown/correction in commodity and equity markets - as confidence in the recovery dwindles.

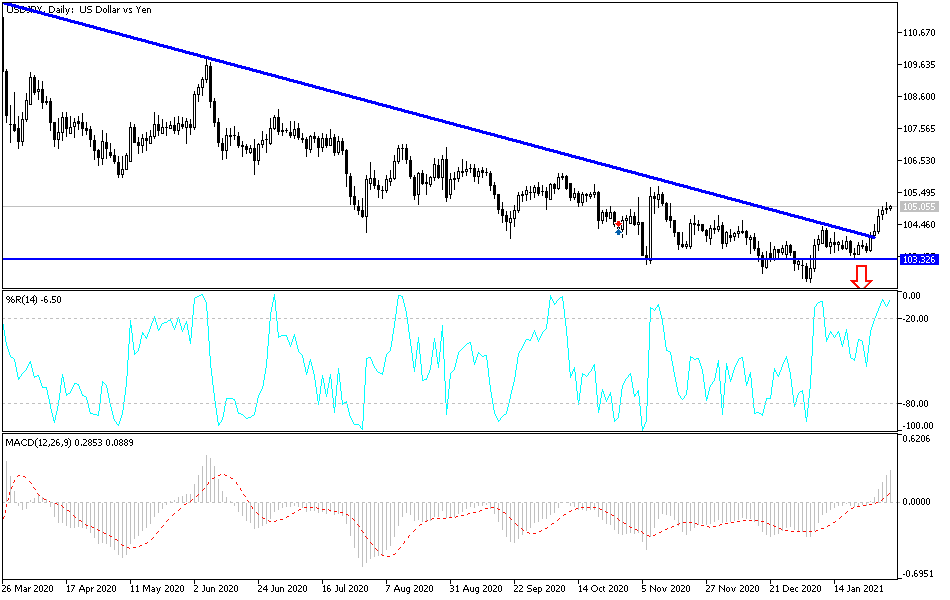

Technical analysis of the pair:

On the daily chart, there is a clear breach of the downward channel, and the USD/JPY is now on its way to test the 106.00 level to confirm a bullish reversal and test higher peaks. The recovery of the pair depends on investor confidence and optimism that global economies will reopen quickly during 2021, especially with the introduction of more vaccines to confront the epidemic amid parallel intensification of stimulus by governments and global central banks. On the downside, bears will regain control over the performance if the pair breaks through the support level of 103.85.

The USD will be affected today by the announcement of the ADP survey to measure the number of US jobs in the non-agricultural sector and the ISM Service PMI reading.