The USD/JPY experienced some profit-taking at the beginning of last week's trading that pushed it towards the support level of 104.40 before recovering and reaching 105.18, closing trading around 104.90. It appears that the conflict between bulls and bears has increased recently after a prolonged downtrend for the currency pair. The widespread declines in the US dollar last week do not necessarily mean that the situation has turned in favor of further weakness in the US currency in the coming months, although it did reinforce the clear trend towards the strength of the British pound and other European currencies. The constantly pessimistic Fed continues to pour cold water on any indication that less political accommodation may be needed than the current situation.

US President Joe Biden and Chinese President Xi Jingping held their first call last Wednesday. Commenting on the event, Stephen Gallo, European Head of Forex Strategy at BMO Capital Markets said: “Trade problems seem to be subsiding, given that the Chinese yuan has appreciated against the dollar by 9.0% over the past few quarters. If this were not the case (or if the US continued to press for a smaller merchandise trade deficit with China), then there would now be a more pronounced bias in the USD/RMB, one way or another. Part of the difficulty is that the aforementioned appreciation of the Chinese yuan reduced the chances of a trade clash last week, and this left investors forced to make broad assumptions about the strategic approach of the United States towards China. On the basis of total return, we will go on to say that short exposures of USD/CNH make the most sense for the near future. But we're more cautious about the CNH estimate side of that equation.”

In a stark sign of the economic inequality that characterized the recession and epidemic recovery of the world's largest economy, Americans are now earning the same amount in wages and salaries they were earning before the outbreak - even with nearly 9 million fewer workers. The shift in total wages highlights how US job loss disproportionately affected workers in lower-income occupations rather than higher-wage industries, where employees have already had jobs in addition to income since early last year.

In February 2020, Americans earned $9.66 trillion in wages and salaries, at a seasonally adjusted annual rate, according to US Commerce Department data. By April, after the virus slowed the US economy, that number had shrunk by 10%. It gradually recovered before reaching $9.67 trillion in December, the most recent period for which data is available. These figures include only the wages and salaries people have earned from jobs. It does not include the money that tens of millions of Americans have earned from unemployment benefits, Social Security and other benefits that go to many other families. The numbers also do not include investment income.

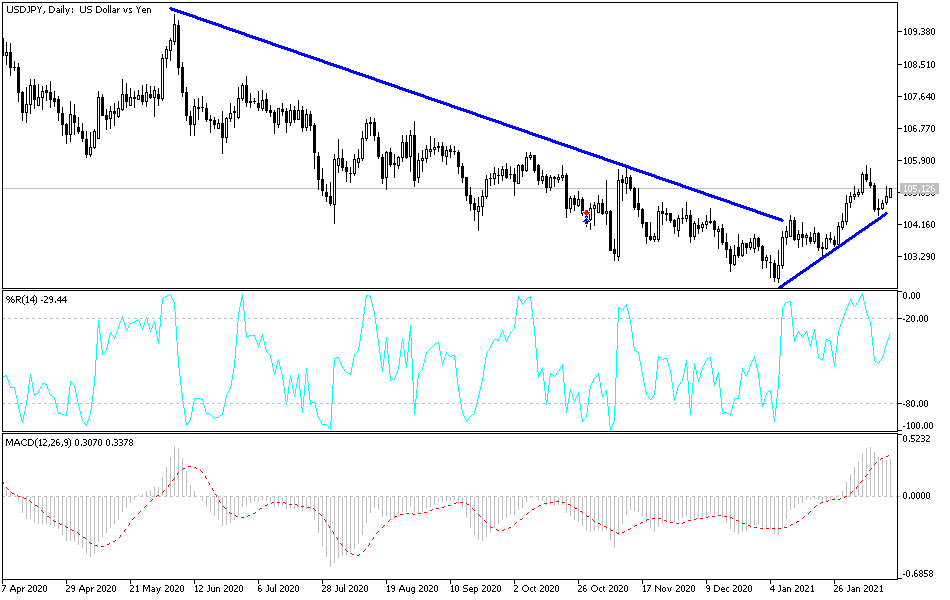

Technical analysis of the pair:

On the daily chart, the USD/JPY is showing a neutral performance, with an attempt to reverse the bearish outlook since the pair started forming a bullish channel in the beginning of the year amid an abandonment of the US dollar. The pair still needs to breach the 106.00 resistance in order for the bulls to have the momentum needed to launch higher. On the downside, stability below the support level 104.00 will support the bearish momentum again.

The currency pair will be affected today by the announcement of the growth rate of the Japanese economy in the middle of an American holiday that may weaken liquidity in the market.