Ahead of testimony by Federal Reserve Governor Jerome Powell later today, the USD/JPY experienced strong bearish momentum. This led to the pair being pushed it towards the 104.98 support level before settling around 105.10 at the beginning of today's trading. For four trading sessions in a row, the pair gives up its recent gains, which extended to the resistance level of 106.22, its highest in five months. Analyzing the possible economic recoveries of major global economies has put pressure on the dollar, which is still facing the unknown regarding stimulus plans and vaccinations, at a time when the United States of America is still leading global figures of injuries and deaths in the epidemic.

US President Joe Biden intends to order that US flags be lowered to half-mast for the next five days in order to commemorate the deaths caused by the coronavirus. White House Press Secretary Jane Psaki said the president will make statements at a later time to commemorate the nearly 500,000 deaths from COVID-19. Psaki says Biden will speak from the White House and ask all Americans to stand for a moment of silence during a candlelit mass at sunset.

The number of deaths due to the coronavirus in the United States is close to 500,000.

At the same time, experts warn of the possibility of about 90,000 more deaths in the next few months, despite the massive campaign to vaccinate people. In recent weeks, deaths from the virus have decreased from more than 4,000 deaths reported on some days in January to an average of less than 1,900 deaths per day.

However, the Johns Hopkins University death toll of half a million is already greater than the population of Miami or Kansas City, Missouri. It is roughly equal to the number of Americans killed in World War II, the Korean War and the Vietnam War combined. It's closer to the events of 9/11 every day for about six months.

On the stimulus front, US Democrats are looking to pass the COVID-19 relief bill quickly. The US House of Representatives is expected to vote on the proposed package from President Joe Biden by the end of the week.

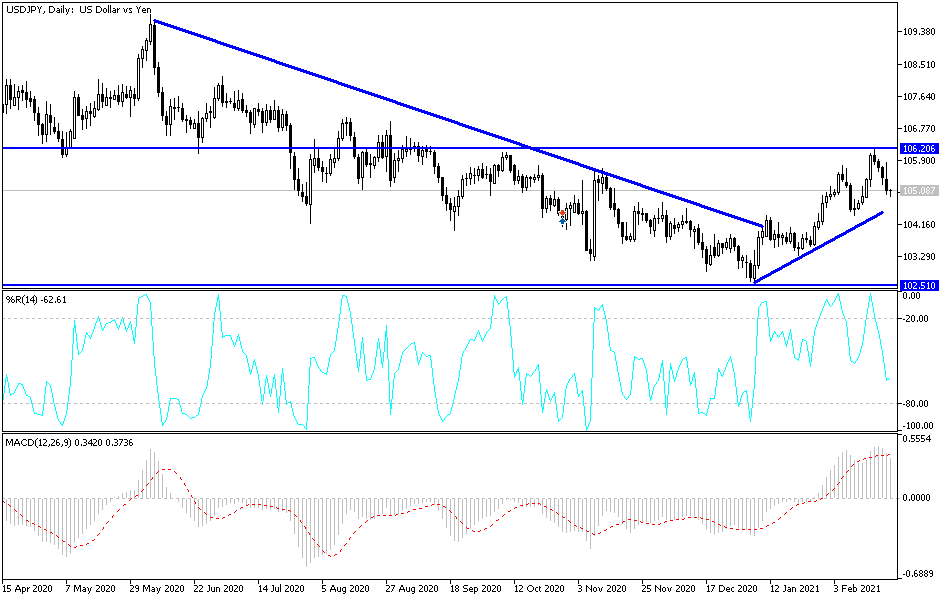

Technical analysis of the pair:

On the four-hour chart, the USD/JPY has made a bearish reversal. The bears' control over the performance will be strengthened in light of stability below 105.00, which may push for a move towards stronger support levels, which are currently at 104.55, 103.90 and 103.00. On the upside, as I mentioned before, the bulls' control will still depend on stability above 106.00 resistance. Still, I would prefer to buy the pair on every downside.

The currency pair will interact today with the extent of investor risk appetite, as well as the reaction from the release of US data, including the Consumer Confidence Index and the testimony of US Federal Reserve Chairman Jerome Powell.