Despite healthy risk appetite, the USD/JPY is still facing downward pressure, retreating during yesterday's session to the 104.92 support level before settling around 105.52 at the time of writing. The recent performance confirms the strength of the correction to the upside in case the pair moves steadily above the 106.00 resistance. The bullish trend still needs more momentum to move towards stronger bullish levels. The dollar faltered and sales resumed in US bond markets after Fed Chairman Jerome Powell neglected to indulge in misplaced speculation that the bank’s quantitative easing program was in the pipeline when he appeared before the Senate Banking Committee yesterday.

The US dollar was trading slightly higher against all of the major currencies, but was later seen heading lower against higher-yielding commodities and growth currencies such as the Canadian and New Zealand dollars and the Norwegian krone, not to mention the pound sterling. The British pound was higher against all the major currencies for the session, week, month and year so far, global markets for risky assets including stocks and commodities were lower, while US bond markets also continued selling.

This came after Jerome Powell told senators in Washington that the world's largest economy will depend on the bank's continued support for some time to come and that its recovery "remains uneven and far from complete."

"Powell did not mention the astonishing speed and the extent of the decline in cases and hospitalizations," says Ian Shepherdson, Chief Economist at Pantheon for Macroeconomics. “With the economy still far from our inflation and employment targets, the Fed believes that the current policy stance remains appropriate; It will be some time before any changes are needed. Inflation is not a threat in the near term, thanks to the impact of COVID-19 on some sectors, but the president reminded senators that even when inflation is high, the Fed wants to see it above the target for some time before raising interest rates."

Financial markets seemed to have convinced themselves in recent weeks that President Joe Biden's $1.9 trillion financial support package would mean that US inflation will be higher this year and next. This, in turn, means that the Fed may have to abandon its pledge to continue buying $120 billion of US bonds per month “until significant progress is made towards achieving the Commission's maximum employment and price stability goals”.

“Powell stuck to a peaceful streak, leading first by the fact that growth and employment gains have slowed since the initial recovery in the third quarter, and only after that recognition of the boom in recent retail activity and the advance against COVID-19,” said Avery Shinfield, Chief Economist at CIBC Capital Markets. Otherwise, the prepared statement was “free of new content”. There was no mention of the potential monetary policy impacts of the stimulus bill.

The Fed fundamentally changed its monetary policy strategy in the past year, pledging to the market that policymakers will not start raising US interest rates until after inflation actually rises above the bank’s 2% target. This is partly to compensate for past periods when price pressures were below target. Meanwhile, despite the accelerated vaccination campaign, the third wave of coronavirus infections in the United States and the resulting restrictions are exacerbating the economy's plight.

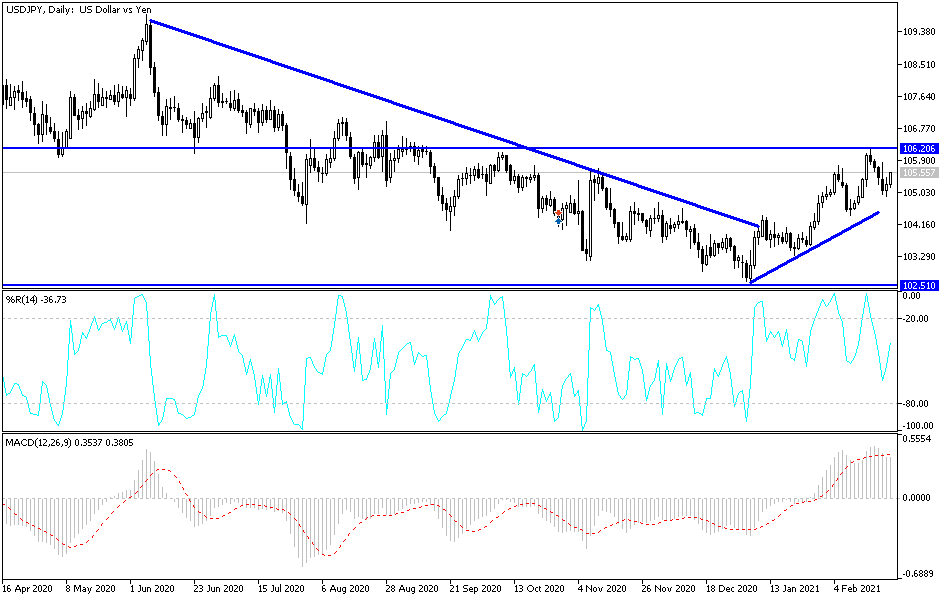

Technical analysis of the pair:

On the daily chart, the USD/JPY is in a neutral position with a slight upward slope and will strengthen in the event that it stabilizes above the 106.00 resistance, which may increase buying to rush towards resistance levels higher, namely at 106.55, 107.20 and 108.00. The psychological peak at 110.00 the most important target for bulls in the long run. On the downside, a break of the 104.85 support will push for a bearish move towards the support at 104.00. All in all, I would still prefer to buy the pair from every downside.

The currency pair will be affected today by risk appetite, along with the announcement of US new home sales and the second testimony of Federal Reserve Chairman Jerome Powell.