The USD/JPY has been moving within a bullish channel, stabilizing around the 105.00 resistance level at the beginning of Tuesday's trading and waiting for more momentum. The recent performance of the currency pair confirms our recommendations to buy the pair from every descending level instead of further selling, as the technical indicators have reached strong oversold levels. The performance of the dollar and global markets await the details of the stimulus plans for the US economy to cope with the effects of the pandemic.

The Institute of Supply Management reported that its ISM manufacturing activity gauge decreased to a reading of 58.7% in January from 60.7% the previous month. The December reading was the highest in the index since it reached 60.8% in August 2018. According to the index data, any reading above the 50 level indicates growth in the manufacturing sector. The January figure indicates growth in the overall economy for the eighth consecutive month after the contraction in March, April and May.

The ISM survey of companies showed that 16 of the 18 industries showed growth in January. Survey respondents were mostly optimistic once again, as demand continued to grow in new orders, although at a slower pace than the previous month. Employment grew for the second month in a row after the contraction in November, but it remains a cause for concern. Commenting on the findings, ISM President Timothy Fury said: “Labor market difficulties in committee member companies and their suppliers will continue to restrict manufacturing growth until the coronavirus crisis subsides.”

Overall, the growth of the US economy was subjected to expansion due to the outbreak of the coronavirus from April to June, but manufacturing has recovered to a large extent since then. The service sector, which includes restaurants, bars and the travel industry, has been hit the hardest and continues to struggle as people choose to stay home. In a separate report last week, the Commerce Department said orders to US factories for manufactured durable goods rose 0.2% in December, weighed by a major downturn in the volatile aircraft sector. This followed stronger increases of 1.2% in November and 1.8% in October.

Last week, the government estimated that the US economy contracted last year by 3.5%, the largest contraction in 74 years. Economists say the outlook for 2021 is mired in uncertainty and warn that a sustainable recovery will likely not take hold until the majority of Americans are vaccinated and government-mandated financial aid spreads across the economy - a process that will likely take months.

The death toll in the United States of America has risen to more than 440,000, with more than 95,000 people killed in January alone. The death rate is around 3,150 per day on average, down slightly from about 200 from its peak in mid-January. But as the calendar turned into February, the number of hospitalized Americans with COVID-19 fell below 100,000 for the first time in two months. The average number of new infections is about 148,000 per day, down from a quarter of a million cases in mid-January. Cases are declining in all 50 states.

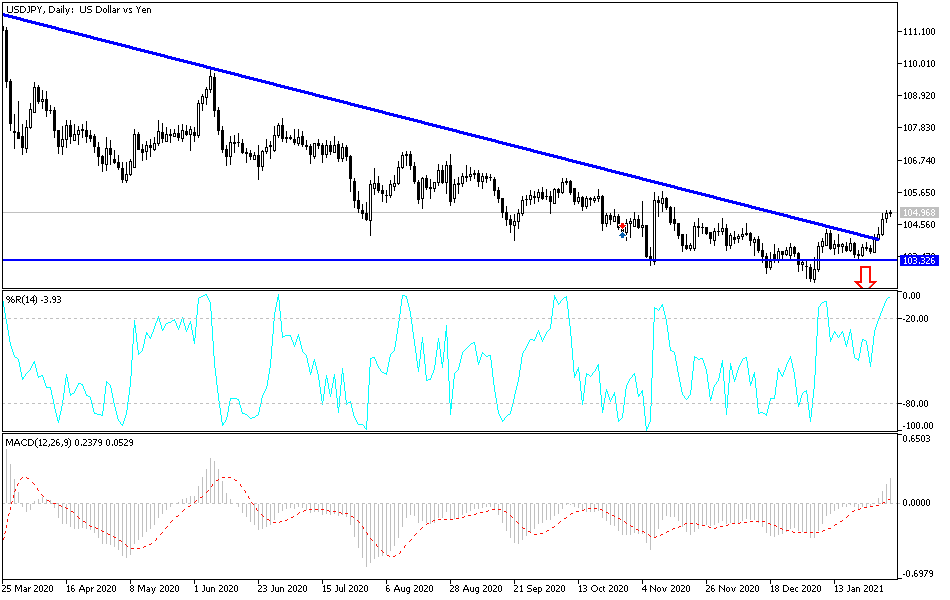

Technical analysis of the pair:

On the four-hour chart, the gains of the USD/JPY have pushed technical indicators into strong overbought areas, and without getting more momentum, the currency pair may be subject to profit-taking sales. On the daily chart, the currency pair still has the opportunity to move upwards. In general, I think that the currency pair may maintain its gains until the important US jobs numbers are released this week. The currency pair is closest to the 106.00 resistance, which we identified a lot as important for a bullish trend reversal. On the other hand, the bears will not regain control of the performance without moving below the 103.00 support level.

Today the currency pair is not anticipating any important Japanese or US data.