For the third day in a row, the USD/JPY is moving lower due to profit-taking. The pair is stable around the 104.75 level as of this writing, and its recent gains were capped by a test of the 105.76 resistance level, its highest in four months. The disappointing US jobs report still haunts the dollar, in addition to the weakness of the United States' progress in vaccinations.

Democrats in the U.S. House of Representatives have proposed an additional $1,400 in direct payments to individuals as Congress begins assembling a $1.9 trillion relief package from COVID-19. Democrats on the Ways and Means Committee will expand tax breaks for families with children, low-income people and those who buy health insurance in markets created by the Affordable Care Act of 2010. The committee, which plans to approve the measure by the end of the week, will also provide health care benefits for some unemployed workers.

President Biden has declared that defeating the virus and reviving the economy were his top priorities, though he recently stated that "there is nothing we can do to change the trajectory of the virus over the next several months". The COVID-19 virus has killed more than 460,000 Americans while the economy has lost 10 million jobs since the crisis began last year.

In the first weeks of 2021, the number of daily confirmed cases continued to spiral out of control, rising to more than 200,000 and then creeping to 300,000. The number of daily deaths sometimes exceeded 4,000. By mid-January, the total number of American deaths had exceeded 375,000, with no immediate improvement in sight. Joe Biden had pledged to administer 100 million doses in his first 100 days in the White House, in keeping with the pace Trump had kept while he was in office.

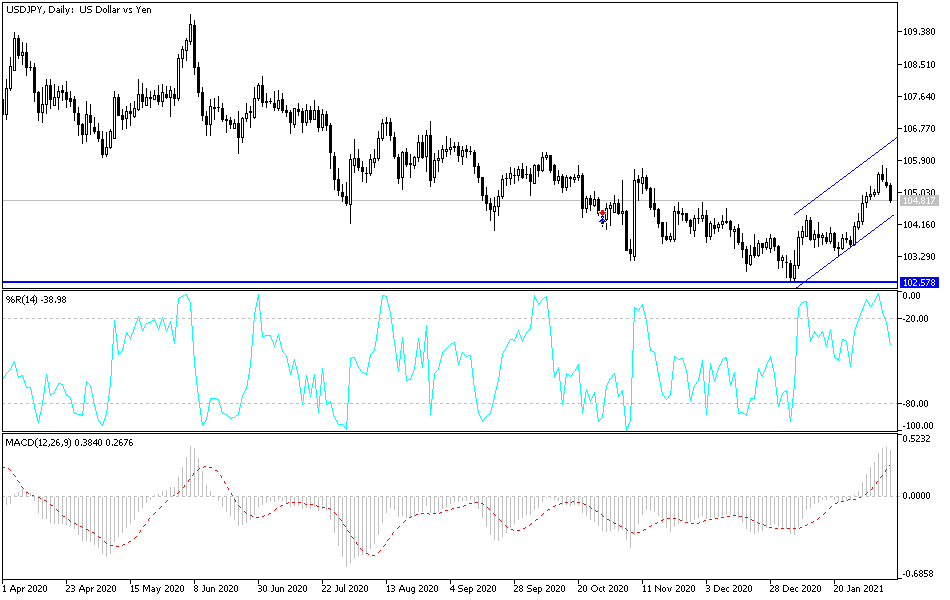

Technical analysis of the pair:

On the daily chart, the USD/JPY is still moving within its bearish channel and there has not yet been a breakdown of the trend. A reversal may happen only if the price moves below the support level 104.00. To the upside. the 106.00 resistance level will remain a target for bulls.

The currency pair is not anticipating any important economic data today, and investor risk sentiment will have the strongest impact on the pair.