After a long wait, the USD/JPY jumped to the 106.07 resistance level amid an upward correction path after a clear abandonment of the yen as a safe haven. The current bounce gains have pushed the pair to its highest in four months ahead of important events, the most prominent of which is the content of the minutes of the last meeting of the Federal Reserve. The dollar’s gains are still subject to the passage of US economic stimulus plans.

President Joe Biden has extended the ban on foreclosures until June 30 to help homeowners struggling during the coronavirus pandemic. The federally secured mortgage ban was due to expire on March 31. Census Bureau figures show that nearly 12% of homeowners who have mortgages are late with their payments.

Accordingly, the White House says that the coordinated measures announced yesterday by the Departments of Housing and Urban Development, Veterans Affairs and Agriculture will also extend to June 30, the registration deadline for borrowers who wish to request temporary suspensions or reductions in mortgage payments.

According to data from Johns Hopkins University, there were 53,883 new cases of COVID-19 and 989 deaths in the United States on Monday. The record for new cases was 300,282 on January 2nd and the record for deaths was 5443 on February 12th. The total number of deaths from COVID-19 in the United States has reached 486,994.

The Biden administration is trying to vaccinate enough Americans to achieve "herd immunity" and allow life to return to a semblance of normal life, despite Biden continuing to support school closures and saying that there is "nothing we can do" about the trajectory of the virus. His team also argues that the federal government should keep the government relief faucet open to help people struggling economically and return the country to the employment levels it was in before the pandemic. But lawmakers on both sides of the aisle oppose the price of the package, which would send funds to state and local goverments to cover debts incurred before the pandemic.

Manufacturing activity in New York grew at its fastest pace in months in February, according to a report from the New York Federal Reserve. The bank said its General Business Conditions Index jumped to a reading of 12.1 in February from a reading of 3.5 in January, with a positive reading indicating growth in regional manufacturing activity. Economists had expected the index to rise to 6.0.

With a much larger increase than expected, the General Business Conditions Index reached its highest level since it reached 17.0 last September.

The rise in the headline index was partly due to the acceleration of new order growth, with the New Orders Index rising to 10.8 in February from 6.6 in January. The headcount index also increased to 12.1 in February from 11.2 in January, indicating a slightly faster rate of job growth.

The Federal Reserve Bank of New York also said that its index of future business conditions rose to 34.9 in February from 31.9 in January, indicating that companies remain optimistic about future conditions.

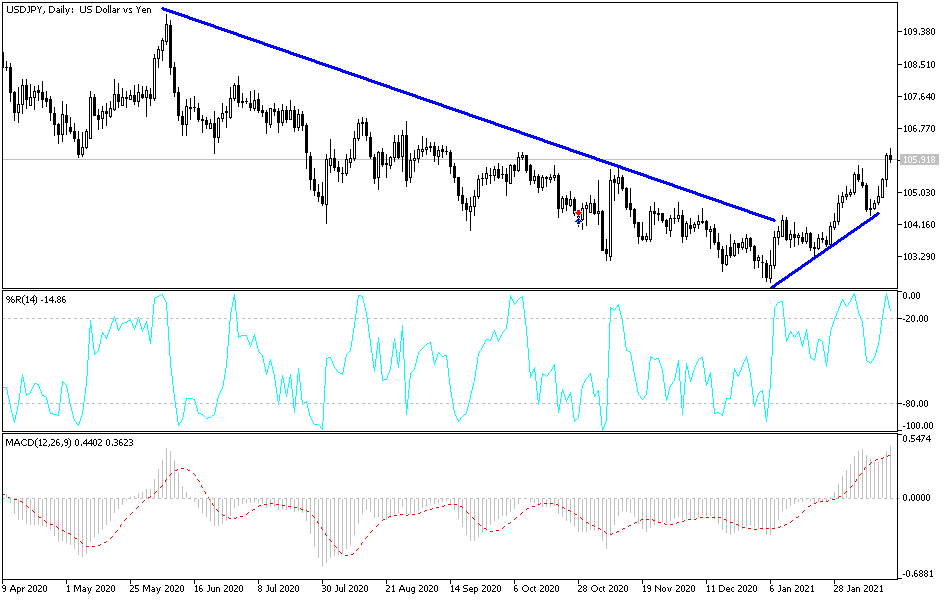

Technical analysis of the pair:

A breach of the 106.00 resistance level will support the upward correction of the pair and trigger a bullish move towards higher levels, the closest of which are currently 106.35, 107.00 and 107.75, which are important areas for bulls to then hit the psychological resistance of 110.00. According to the performance on the daily chart, there is a clear break of the bearish trend, and the bears will not control the performance without breaching the support levels at 104.83 and 104.00.

The pair's gains will remain dependent on today's events, which include the release of US retail sales numbers, producer prices, and the contents of the minutes of the last meeting of the US Federal Reserve. This is in addition to the extent of investor risk appetite and the future of the emergency US economic stimulus plans.