USDT/USD is trading slightly above 1.0000 USD in early trading today and has maintained a positive stance short term. Trading in Tether has proven to be slightly bullish in the wake of an announced settlement which concluded the investigation into accounting failures by Tether and its sister company Bitfinex under the corporate umbrella of iFinex on Tuesday.

An 18 million USD fine has been agreed upon to be paid as a penalty regarding accounting failures. However, New York State and Tether have predictably offered different perspectives regarding the conclusion of the investigation. Tether and Bitfinex, while forced to pay a fine, have avoided further legal actions. New York State has made quarterly accounting mandatory from the companies, which it says will require greater transparency from Tether and Bitfinex.

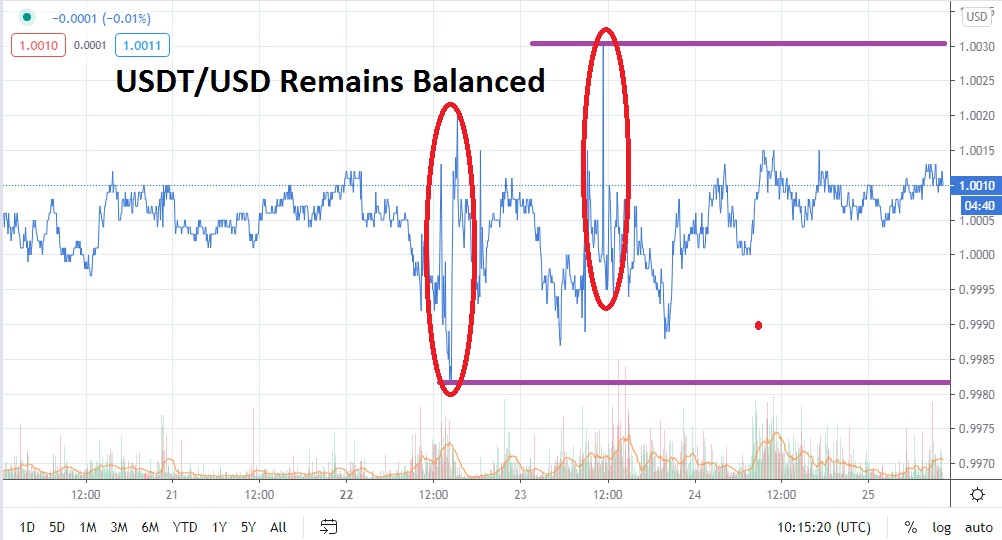

Speculators have seemingly treated this news development in a positive manner and the move above 1.0000 for USDT/USD has been of interest the past day. Traders may be inclined to rest comfortably after the investigation in New York State has concluded and return to their technical charts with the belief that they can pursue incremental changes in support and resistance levels in a patient manner, and this is likely correct over the mid-term.

Tether is a key barometer within the cryptocurrency marketplace regarding sentiment and the lack of further legal action within New York may prove to be positive for other cryptocurrencies too. However, traders should be aware that New York didn’t exactly let Tether and Bitfinex off the hook and did accuse them of obscuring risks and lying about their accounting practices.

Speculators who trade Tether have likely taken into account the shadows that hovered over the digital asset. Tuesday’s agreement between New York State and Tether allows traders to focus on trends in the cryptocurrency marketplace again. The notion that Tether is trading above 1.0000 USD and will see slightly bearish movement take place is a logical perception and reason to pursue selling positions.

Traders who decide to wager on Tether need to have patience and make sure transaction fees do not curtail their potential profits. Speculating on Tether to produce a trend and maintain its status as a stable coin which traverses fractionally above and below the 1.0000 USD mark are worth pursuing, but traders need to use tactical methods and limit orders to profit when trading USDT/USD.

Tether Short-Term Outlook:

Current Resistance: 1.0013

Current Support: 1.0004

High Target: 1.0015

Low Target: 0.9990